CHEMICAL UPDATE

JANUARY 2009

McIlvaine Company

TABLE OF CONTENTS

MARKET

ACC Releases October / November 2008 Global Chemical Industry Production Index

EU Chemical Industry Moderate Decline in 2008 / 2009 Prospects Negative

South Korea's Petrochemical Industry Likely to be Downsized in 2009

COMPANY NEWS

US Arm of LyondellBasell Goes into Chapter 11 Bankruptcy Protection

Solvay PEEK Replaces Costly Metals in Critical Applications

PROJECTS/ EXPANSIONS/ACQUISITIONS

EU Commission Agrees to Dow Chemical's Buy of Rohm & Hass

Dow Sells TPU Business to Lubrizol

Mitsubishi Rayon Prepares to Complete Lucite Acquisition in January

Foster Wheeler Wins EPCM Contracts for Propylene Facility in Thailand

Samsung and Linde Secure $1.43 Billion Contracts for Indian Petrochemicals Complex

Agility Global & Borouge to Set Up Polyolefins Unit in Shanghai

Poland's PKN Orlen Investing $1.3 Billion on Petrochemical Capacity Expansion

CNOOC Begins Construction of 800,000-Ton Methanol Project in Hainan

U.S. Firm Invests in Coal-Chemical Project in China

MARKET

ACC Releases October / November 2008 Global Chemical Industry Production Index

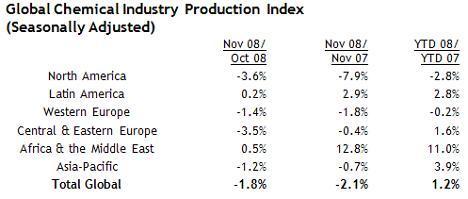

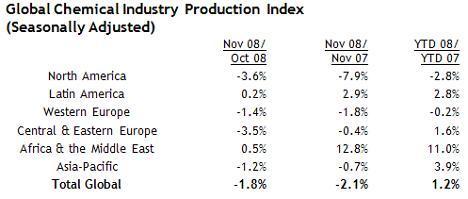

According to the American Chemistry Council (ACC), global chemical industry production fell 1.8% in November. This follows a slight gain in October and declines in August and September, part of a pattern of generally soft activity since January. Gains were limited to Latin America. Elsewhere, activity was declining. Compared to a year earlier, production is off 2.1% Y/Y on a three-month, moving-average (3MMA) basis and stood at 122.4% of its average 2002 levels. The year-earlier comparisons moderated significantly since 4th quarter 2006 and turned negative in October. Amid customer destocking, sales have declined and orders are off significantly. Leading indicators of global industrial production continue to suggest additional soft activity in underlying final demand although customer inventories could be depleted in the 1st quarter.

EU Chemical Industry Moderate Decline in 2008 / 2009 Prospects Negative

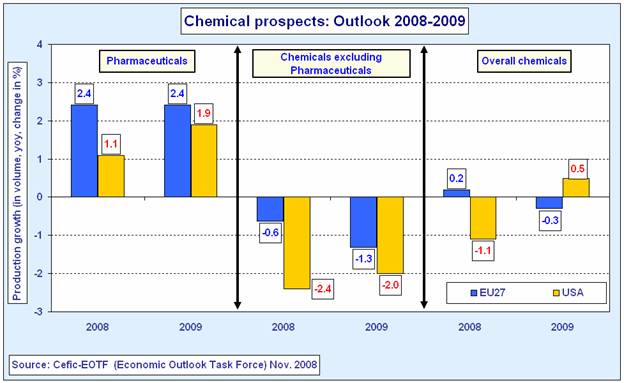

Cefic, the European Chemical Industry Council, expects output in the chemical industry (excluding pharmaceuticals) to decline by 0.6% in 2008. The downward trend will continue in the coming months. Expectations for 2009 are relatively more severe with a negative growth of 1.3% .

For the first time since 2003, the EU chemicals industry’s output (without pharmaceuticals) experienced negative growth in 2008. After a modest start in the first quarter, output has declined in the course of the year, especially since the third quarter. Chemicals used in industrial sectors and the key customer sectors are still seriously affected by the dramatic slowdown in EU economic activity and the sharp deceleration of world output and trade. A key element is the US financial crisis, which has adversely affected the key industrial sectors in the USA and the main competing areas in the world. During the second half of 2008, the effects of the financial crisis on the real economy have accelerated the downturn in the key customer sectors of chemicals such construction, automotive, and machinery and equipment, consequently impacting the chemical industry.

Looking ahead, Cefic expects a decline in output of 1.3% in 2009 for the EU chemical industry (excluding pharmaceuticals). Most chemical sub-sectors will show a downward trend and experience a more severe decline compared to 2008. Consumer chemicals are the only exception, where a modest recovery is projected for 2009.

Prospects for the EU chemical industry remain relatively sensitive to some key downside elements linked to uncertainties about the spill-over effects of the financial crisis on the real economy and the deteriorating trend of industrial demand of the key customers of the EU chemicals industry,

Global Economic Environment

Cefic predicts zero growth for EU GDP next year, down from 1.3% in 2008. World GDP is expected to grow by 2.8% in 2008, anticipating even more severe economic slowing next year around 1.2%

South Korea's Petrochemical Industry Likely to be Downsized in 2009

Industry experts are anticipating the automobile, petrochemical and semiconductor sectors in South Korea to become the next victims of downsizing. This follows the recent announcement made by the Financial Supervisory Service in Seoul, South Korea, the country's financial watchdog, to downsize the construction and shipbuilding sector in early 2009.

The petrochemical industry has come under scrutiny as a result of weakening demand and the subsequent slump in prices, and faces downsizing on excessive investments toward setting up new production facilities or capacity expansion projects. According to the Samsung Economic Research Institute (SERI), domestic demand for petrochemicals in Korea is likely to fall by 1.6% from 2008 to about 9.35 million tons in 2009. The SERI also indicated that the sector would see sluggish business activity in 2009 because of the slump in demand from downstream industries, including manufacturers of appliances and automobiles.

Asia's polymer markets are reeling under the influx of low-priced goods from South Korea, the U.S. and the Middle East. Firms from these countries have taken to offloading goods at low rates to several countries in order to avert a domestic crisis. The SERI predicted a marginal growth of 5.3% in South Korean exports of petrochemicals to 11.2 million tons in 2009 compared with the previous year after having recorded a 36.6% decline in 2008 from 2007.

COMPANY NEWS

US Arm of LyondellBasell Goes into Chapter 11 Bankruptcy Protection

The US arm of LyondellBasell Industries, the chemicals group that is part of the business empire of Len Blavatnik, the Russian-born oligarch, recently filed for bankruptcy protection in New York. The company has suffered as the recession continues to weaken demand for products made from chemicals.

LyondellBasell said that one of its European holding companies had also filed for bankruptcy protection and that it arranged for up to $8 billion (£5.4 billion) in financing to keep operating. The private company took on billions of dollars in debt obligations a year ago, when Mr Blavatnik led a $12.7 billion leveraged buyout of Lyondell, an American company, by Basell of the Netherlands.

Solvay PEEK Replaces Costly Metals in Critical Applications

With the recent start-up of its 500 ton/year production unit in Panoli, India, Solvay now delivers KetaSpire® PEEK and AvaSpire® modified PEEK – two ultra polymers that can give design engineers chemical resistance and mechanical properties, plus ease of processing.

Design engineers can specify PEEK as a lightweight alternative for use in automotive, oil & gas, healthcare, aerospace, semiconductor and various industrial friction and wear components. KetaSpire and AvaSpire resins are part of Solvay’s complete family of Spire® Ultra Polymers.

PROJECTS / EXPANSIONS / ACQUISITIONS

EU Commission Agrees to Dow Chemical's Buy of Rohm & Hass

Dow Chemical won permission from the European Commission to buy specialty chemicals counterpart Rohm & Haas.

The Commission, the competition watchdog of the 27-nation European Union, said that despite overlaps—especially in crude acrylic acid and its derivatives and in ion exchange resins—the transaction would not impede competition and that the merging parties were not each other's closest competitors.

"The merged entity would continue to face a number of effective competitors at each point in the value chain where crude acrylic acid and its derivatives are used," the Commission said in a statement.

Dow Chemical announced in July that it would buy rival Rohm and Haas for $15.3 billion in a move to broaden its product offerings in higher margin markets such as paints, coatings and electronic materials.

Questions have arisen regarding Dow’s ability to purchase Rohm and Haas since last month’s scrapped deal with Kuwait's state-owned Petrochemicals Industries. Dow agreed to sell a large portion of its basic plastics assets into a joint venture with Kuwait Petroleum Corp. Dow recently said it was preparing legal action for "breach of contract" in pulling out of the project. Kuwait was to pay 7.5 billion dollars.

Dow Sells TPU Business to Lubrizol

The Dow Chemical Company has announced the sale of its Thermoplastic Polyurethane (TPU) business including the production plant in La Porte, TX, customer lists, contracts and technology to Ohio-headquartered specialty chemicals company Lubrizol Corporation.

"The decision to sell the TPU business was based primarily on the fact that the TPU business is healthy and growing, but does not align to Dow's transformational strategy," said Mike Szabo, Global Product Director, TPU.

Mitsubishi Rayon Prepares to Complete Lucite Acquisition in January

Mitsubishi Rayon Company Limited, Japan, is expected to complete the pending acquisition of Lucite International Limited, UK, on January 27. The estimated $1.6 billion acquisition, which was announced in November of 2008, encompasses all of Lucite's businesses throughout the world, including 14 manufacturing locations.

Lucite International is a leading producer of methyl methacrylate (MMA) monomers, one of the basic materials used to produce acrylic resins. This continues to be a growth market for Lucite, which has plans for the construction of at least two additional grassroot MMA plants in the next two years—one in China and another in Saudi Arabia. Despite the apparent positive long-term outlook, MMA production is not immune to current market woes. Lucite's Nederland, Texas, plant site has been idle since late December because of market constraints, and no definitive date for a restart is known. Several planned maintenance turnarounds for this site have been changed from the first quarter of 2009 to September.

Foster Wheeler Wins EPCM Contracts for Propylene Facility in Thailand

Foster Wheeler Limited, New Jersey, a global engineering and construction company, has announced that its Thailand-based subsidiary, Foster Wheeler International Corp. has bagged engineering, procurement and construction management (EPCM) contracts from MTP HPPO Manufacturing Company Limited, Thailand for a new chemicals facility in Banchang near Map Ta Phut. MTP HPPO is a subsidiary of Siam Styrene Monomer Company Limited, a joint venture between The Dow Chemical Company and The Siam Cement Public Company Limited, Bangkok.

Foster Wheeler will provide EPCM services to build a new 390,000-ton-per-year propylene oxide plant and for the power, utilities and infrastructure project, which will in turn feed the new chemical facility. The company's Thai branch has completed the front-end design for the project. Foster Wheeler has also been awarded the contract for overall services support. The company expects the plant to be commercially operational by 2011. The financial terms and value of the contracts has not been disclosed yet.

Propylene oxide is prepared from propylene and hydrogen peroxide. Raw material for producing propylene oxide will be supplied by Map-ta-phut Olefins Company and Dow's joint venture with Solvay S.A, Belgium.

Foster Wheeler's role in MTP HPPO's upcoming chemical facility is of paramount importance to the Thai Growth project. MTP HPPO will leverage on Foster Wheeler's expertise to set up chemical facilities, execute EPC projects, and the advantage of delivering locally from Sriracha.

Samsung and Linde Secure $1.43 Billion Contracts for Indian Petrochemicals Complex

ONGC Petro Additions Limited, Gujarat, a subsidiary of state-owned Oil & Natural Gas Corporation, recently awarded contracts valued at $1.43 billion to a consortium of Samsung Engineering Company, Korea, an engineering, procurement and construction (EPC) firm, and Linde AG, Germany, an industrial engineering firm, for the construction of a dual-feed ethylene cracker unit and auxiliary facilities at the proposed petrochemicals complex in the Dahej Special Economic Zone in Gujarat.

Samsung's order, valued at $960 million, involves engineering, procurement, construction and assembly of the plant. Linde's contract, valued at $470 million, covers implementation of the unit, including supply of the steam cracker technology and engineering and provision of critical components.

The two firms will set up the ethylene cracker unit, which has a production capacity of 1.1 million tons per year of ethylene and 340,000 tons per year of propylene. The unit will be India's first dual-feed ethylene cracker to be based on naphtha and gas and also constitutes the single largest component of ONGC's mega-petrochemicals project at Dahej. The project is slated for completion by July 2012.

ONGC's $2.8 billion project will be based on a dual supply of gas and naphtha. The proposed facility will process gas imported by Petronet LNG Limited, New Delhi, to extract ethane and propane for further use to manufacture polymers. Naphtha, another key raw material for the manufacture of petrochemicals, will be sourced from ONGC's processing plants at Hazira and Uran. ONGC's upcoming C2-C3 extraction plant at Dahej will be integrated with the proposed petrochemicals complex.

The petrochemicals complex will have a production capacity of 1.1 million tons per year of ethylene, 400,000 tons per year of propylene, 150,000 tons per year of benzene, and 115,000 tons per year of butadiene. All of these products find application as raw materials in the plastics industry. The project, which is also the largest plant contract to date in India's hydrocarbon sector, is slated for commissioning by December 2012. GAIL India Limited, New Delhi, one of the largest gas utilities in the country, has expressed an interest in picking up a 19% stake in the project.

OPAL is a special purpose vehicle set up by ONGC and Gujarat State Petroleum Corporation Limited, a state-owned oil and gas firm, for the Dahej petrochemicals project. ONGC holds a stake of 26% in OPAL while GSPC holds a stake of 5%.

Agility Global & Borouge to Set Up Polyolefins Unit in Shanghai

Borouge, United Arab Emirate, a manufacturer of plastics, and Agility Global Integrated Logistics, Kuwait, a global logistics provider, are setting up a logistics hub in Shanghai to receive over 600,000 tons per year of polyolefins, consisting of polyethylene and polypropylene in bulk containers from the Borouge Middle East gateway in Ruwais, United Arab Emirates. The facility is being developed over a land area of 70,000 square meters. Construction of the hub is scheduled to be completed by 2009. The facility is slated to be fully operational by May 2010, employing about 120 personnel from Agility's workforce.

Agility is also setting up a compound manufacturing unit for Borouge at the same site in Shanghai. Spread over a land area of 30,000 square meters, the facility will have a production capacity of 50,000 tons per year of compounds manufactured from enhanced Borstar polypropylene and will cater to the Shanghai market. These compounds will be used in automotive, domestic appliance, electrical and power-tool applications.

In August 2008, Borouge awarded a $220 million service contract to Agility to set up the Shanghai Logistics Hub and the Borouge compounds manufacturing unit in Shanghai and to provide local logistics services for Borouge's customers in Asia for a period of 10 years, starting in 2010. The proposed facility is being set up by the firm in a bid to move closer to customers in Asia. Under the contract, Agility was entrusted with the responsibility of design, development and subsequent operations of the facility to provide adequate packaging and distribution services and storage facilities for Borouge's products dispatched from Abu Dhabi. On November 28, 2008, the two firms broke ground for the Shanghai Logistics Hub.

Borouge is a joint venture entity set up by state-owned Abu Dhabi National Oil Company, one of the largest oil and gas companies in the world, and Borealis A/S, Austria, a provider of plastics solutions. Borouge's petrochemical complex in Ruwais has a current production capacity of 600,000 tons per year of Borstar polyethylene, which will go up to 2 million tons per year upon completion of the ongoing Borouge 2 expansion project. The firm will also add polypropylene to its product portfolio as part of the expansion. The upcoming Borouge 2 facility is being equipped with a 1.5 million-ton-per-year ethylene cracker unit, the world's largest olefins conversion unit with a capacity of 750,000 tons per year, two plants to produce Borstar polypropylene with a total production capacity of 800,000 tons per year, and a Borstar polyethylene plant with a total production capacity of 540,000 tons per year.

Poland's PKN Orlen Investing $1.3 Billion on Petrochemical Capacity Expansion

Poland's leading oil corporation, Polski Koncern Naftowy has announced plans to invest more than $1.3 billion on doubling the capacity of its 800,000-ton-per-year petrochemical plant. The capacity expansion will be carried out during a five year period. The expansion will increase the production of both Teraphthalic acid and Paraxylene by 600,000 tons per year. The final products from the petrochemical complex will be supplied to the country's chemical sector. PKN Orlen is now focusing on becoming one of the primary petrochemical suppliers in Poland.

CNOOC Begins Construction of 800,000-Ton Methanol Project in Hainan

China National Offshore Oil Corporation, Beijing, has begun construction of a $147 million, 800,000-ton-per-year methanol project in Dongfang Chemical City in Hainan province, Industrial Info Resources reports. The project is being funded by CNOOC's Chemical Company Limited.

The methanol plant will be the downstream auxiliary facility for the development of the Ledong gas field. The plant is expected to begin production in late October 2010. Because the natural gas from the Ledong field is characterized by its high nitrogen and carbon-dioxide content and low heat value, the plant will adopt advanced Davy Process methanol-production technology from the U.K. Features include energy efficiency, a short production cycle, minimal equipment and space utilization, and high added economic value.

The designed daily production capacity is estimated at 2,500 tons. It is expected that the energy consumed per ton to produce methanol at the new facility will be much lower compared with average medium-scale methanol facilities in China. The quality of methanol products from this unit will meet U.S. AA standards.

In addition to using energy-efficient equipment and new insulation materials, the Davy system employs hydrogen-recycling, pre-transformation, low-pressure methanol synthesis and exhaust pressure swing absorbing technologies to reduce energy consumption. All of these features will help to reduce the facility's energy consumption during production.

U.S. Firm Invests in Coal-Chemical Project in China

A U.S. company is considering investing more than $1 billion to develop the coal-chemical business in China's northeast region. Synthesis Energy Systems Incorporated (SES), Texas, an energy and technology company focusing on China, has negotiated with the local government of the Inner Mongolia Autonomous Region, planning to earmark $1.3 billion in a large-scale coal-chemical project in the coal-rich region.

Lorenzo Lamadrid, Chairman of SES, recently paid a visit to China, where the investor plans to build a 2.4-million-ton-per-year methanol plant and a 1.6-million-ton-per-year dimethyl carbinol project, finishing them in three phases, according to China's official Xinhua News Agency.

SES plans to set the project in the Economic and Technology Development Zone of Xing'an Prefecture, which is rich in coal and various non-ferrous metals. The local government has suggested that SES pay more attention to China's existing coal-chemical industry and choose a Chinese company with which to cooperate.

SES previously announced a similar project in cooperation with Yima Coal Group in China's central Henan province. With the U-GAS technique, the Henan project features reduced costs and lower emissions.

By the end of 2008, another SES project in Inner Mongolia will be ready to run. This project, started in June 2006, includes a 22,500-ton-per-year methanol unit and a 150,000-ton-per-year dimethyl ether unit, in cooperation with a local company.

Recent reports show that around $60 billion are planned to be invested in the coal-chemical industry, with more than 30 large-scale companies in the field. However, when oil prices fall, the profit margin for coal-related business diminishes at a fast pace.

China's National Development and Reform Commission issued a notice this summer, banning all except two coal-to-oil projects. One of these projects is being constructed by South African company Sasol, Johannesburg. Other coal-chemical projects are not affected.

McIlvaine Company

Northfield, IL 60093-2743

Tel: 847-784-0012; Fax: 847-784-0061

E-mail: editor@mcilvainecompany.com

Website: www.mcilvainecompany.com