CHEMICAL UPDATE

MARCH 2009

MCILVAINE COMPANY

TABLE OF CONTENTS

Chemical Firms Cutting Capital Spending, R&D in 2009

ACC Releases December 2008 Resin Production and Sales Stats

PhRMA Praises Economic Stimulus Bill

U.S. Prescription Drug Shows Slowest Growth Rate in Thirty Years

California Has the Largest Concentration of Biomedical Companies in the World

Norway Provides Stimulus Package for Biotech Industry

HHS Opens U.S. FDA Offices in India

BASF Commissions New 90,000-Ton Expandable Polystyrene Unit in Germany

Eastman to Reduce Costs by an Additional $100 million

Air Liquide Commissions Two New Industrial Gas Plants in Oman

PROJECTS/ EXPANSIONS/ACQUISITIONS

Octal Petrochemicals and Port of Salalah ‘Tank Farm’ Project Agreement

Merck to Buy Schering-Plough in a $41.1 billion Deal

Millipore Acquires Guava Technologies

Future oriented spending plans for a group of 13 U.S. chemical companies have changed since last year, with capital expenditure plans spending slashed on average 25.1 percent. The companies forecast they will spend a total of $7.5 billion on new plants and equipment in 2009, compared to nearly $10 billion in 2008, according to a survey by C&EN.

R&D spending for a subgroup of six firms plan a 1.8 percent cut in budgets to $699 million, vs. $712 million in 2008.

Dow Chemical is cutting its 2009 capital expenditure budget in half to $1.1 billion, and has no estimates on its R & D budget for 2009, as of the time of the survey.

Lubrizol has scheduled an almost 20 percent cut to its capital budget in 2009, and plans to cut R&D expenditures by a little more than 3 percent.

Because of the increase in capital spending in recent years, the ratio of investment in new equipment to investment in research is still historically high. Budgets for 2009 direct 82.4 percent of funds to capital projects.

Funding devoted to R&D does not fluctuate as much from year to year, since research requires work on multiyear projects.

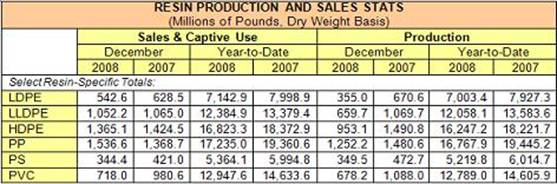

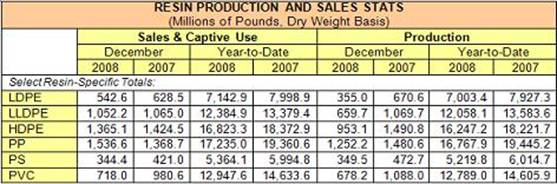

U.S. production of major plastic resins totaled 4.4 billion pounds during December 2008, a decrease of 32.6 percent compared to the same month in 2007, according to statistics released today by the American Chemistry Council (ACC). Year-to-date production was 72.9 billion pounds, a 12.3 percent decrease compared to the same period in 2007.

Sales and captive (internal) use of major plastic resins totaled 5.7 billion pounds during December 2008, a decrease of 6.6 percent from the same month one year earlier. Year-to-date sales and captive use was 74.8 billion pounds, a 9.9 percent decrease compared to the same period in 2007.

The figures are based on primary data for selected major plastics materials as compiled by Veris Consulting, LLC, for ACC’s Plastics Industry Producers’ Statistics Group.

Pharmaceutical Research and Manufacturers of America (PhRMA) President and CEO Billy Tauzin issued the following statement in February regarding health care provisions in the final economic stimulus bill:

“The economic stimulus bill makes an important contribution to better health care for Americans. These provisions will help workers who lose their job retain their health insurance and will allow states to sustain their Medicaid programs. These are the right steps during these challenging times.

“The stimulus bill also provides support for the important work of moving toward electronic health records, which offers promise as a tool to promote higher quality care, including enhanced prevention and management of costly chronic illnesses.

“In addition, the bill provides over a billion dollars of government funding for comparative effectiveness research. Throughout the discussion of this issue in the stimulus bill, PhRMA maintained its long-standing support for increased government funding of constructive approaches to comparative effectiveness research.

“This initiative evolved in a positive direction throughout Congress’ consideration of the issue. Initial language that pointed toward limiting patients’ access to care was modified to ensure that government comparative effectiveness research supports patient access and the ability of doctors and patients to choose the treatment that’s best for each patient. This was the right choice.

“As the Administration begins to implement this new initiative, we expect it will be done with real transparency, openness, accountability and public input in how research priorities are set and how studies are ultimately communicated and conducted — key points highlighted in Senate discussion of the initiative.

“The bill provides short-term funding for government comparative effectiveness studies. As recognized in senators’ statements, the important work of legislating a long-term policy framework for comparative effectiveness remains to be done. We look forward to working with Sens. Conrad, Baucus and others in Congress and the Administration as they construct a framework focused on improving health and assuring access to high quality medical care.”

A major reduction in real prescription drug spending growth has created a “turning point” in healthcare with several policy implications, according to a study published in December 2008 by the journal Health Affairs as a Web Exclusive. The report, “Prescription Drug Spending Trends in the United States: Looking Beyond the Turning Point,” uses IMS Health information adjusted for inflation to document that U.S. prescription drug spending in 2007 fell to its lowest growth rate in more than 30 years. These dynamics reflect the increased use of generic drugs following patent expiration, a marked decline in the number of new molecular entities approved by the FDA, and a reduction in the number of blockbuster drugs.

The growth, size and composition of prescription drug spending is likely to change dramatically in future years, raising significant healthcare policy implications, according to authors Murray Aitken, senior vice president, Healthcare Insight, IMS; Ernst Berndt, professor of applied economics, Alfred P. Sloan School of Management, Massachusetts Institute of Technology; and David Cutler, professor of economics, Harvard University. Among the observations cited:

· Health spending prospects for payers and consumers appear to be more moderate than previously expected by policymakers, with prescription pharmaceutical costs currently rising very slowly or even falling. Prescription drug spending growth is now likely to be lower than any other major medical care sector.

· A decline in prescription sales growth may stifle or limit investment in research and development — slowing the pace of medical innovation.

· Achieving the right balance between regulatory stringency and the introduction of innovative therapies will rise to the top of healthcare policymaker and industry agendas.

· Used judiciously, cost-sharing initiatives between payers and patients are an effective approach for governments and private payers to limit the growth of future pharmaceutical spending.

· Additional efforts to reduce growth in drug spending levels by limiting the uptake of new therapies ultimately may not be necessary.

In the midst of financial upheaval, the biomedical industry stands out as a bright prospect for stability and growth and one that can play a key role in state and national economic recovery efforts, according to a report released in January by the California Healthcare Institute (CHI) and PricewaterhouseCoopers LLP (PwC). The 2009 Report on California’s Biomedical Industry provides an overview of employment trends, wages, product development pipeline, opportunities and challenges for the industry in California, home to the largest concentration of biomedial companies in the world.

According to the report, the biomedical industry employs 271,000 Californians, and the number climbs to more than a million with the multiplier effect of people employed in firms that offer goods and services in support of the biomedical industry. California’s biomedical companies’ revenues for 2007 topped an estimated $74.5 billion, and there are nearly 900 products in the product pipeline.

California’s biomedical industry employees earn an average annual individual salary of $75,000, up approximately 9 percent from 2006, and 80 percent higher than the state’s average income of $41,580. With nearly 900 biomedical products in development in the state, more than half of which are in the clinical trial phase, California has the largest biomedical industry sector in the country and attracts more venture capital funding than any other state.

Although the numbers are promising, the current global financial crisis will have profound effects for years to come on the biomedical industry, according to the report.

The Norwegian government has decided to pump in just under $300 million to support the beleaguered biotech industry, which like its compatriots around the world has been struggling, Nick Taylor reports in Pharmaceutical Technology. Oslo Cancer Cluster has welcomed the funding, saying it could save 50 percent of the 25 companies it represents that are due to run out of cash in the next 12 to 18 months.

Kristin Halvorsen, Norway’s finance minister, said, “This is the most ambitious fiscal stimulus proposed in more than 30 years to boost growth and employment, and a strong stimulus also when compared with measures introduced in other countries.

“The measures are aimed at addressing the emerging problems in the Norwegian labor market. It is vital to ensure that the measures we implement are targeted, temporary and will contribute to sustainable growth.”

However, the rest of Europe, coffers less swelled with oil money, is still awaiting a stimulus package.

HHS Secretary Mike Leavitt and Commissioner of the HHS Food and Drug Administration (FDA) Andrew C. von Eschenbach, M.D., marked the opening of the HHS/FDA offices in New Delhi, and Mumbai, India.

“Through these offices, we can work more closely with manufacturers to share best practices and ensure producers build quality and safety into food and medical products,” Secretary Leavitt said. “Consumers in India and the United States will benefit from the enhanced safety of good, drugs and medical devices. If called upon, we are also prepared to work with the Indian government as it strengthens its own regulatory institutions.”

HHS/FDA will post 10 experienced officials in India to work closely with industries that ship food and medical products to the United States, to improve safety and quality, which will facilitate the smooth flow of trade. Along with the Office Director, HHS/FDA will have four inspectors and five senior technical experts who will cover food, medical devices and medicines.

These HHS/FDA personnel will provide technical advice, conduct inspections of facilities that export to the United States, and work with Indian government agencies and the private sector to develop certification programs to allow the efficient flow of safe HHS/FDA-regulated goods between the United States and India.

These offices are part of HHS/FDA’s Beyond Our Borders Initiative, which will place 35 HHS/FDA personnel in 14 locations around the world, mostly connected to U.S. Embassies, Consulates and Missions. This initiative will expand HHS/FDA consumer-protection efforts beyond the United States to form collaborative partnerships with governments and industry on product safety.

Chemical company BASF SE, German has set up a 90,000-ton-per-year Neopor plant in Ludwigshafen. The product is an expandable polystyrene (EPS), containing uniformly distributed flame retardant. It is used as an insulation material with an insulating capacity that is about 20 percent higher than that of Styropor, also an EPS manufactured by BASF. Neopor contributes to higher energy efficiency and lower carbon dioxide emissions than Styropor.

The plant is operating on a new extrusion-based process. Unlike the earlier used suspension method, the extrusion process produces granules that are more uniform in size. The process also allows for a predetermined setting of the panel properties such as compression resistance. The new plant will provide BASF with greater flexibility and speed in responding to changing market demands.

According to Martin Brudermuller, a member of BASF's Board of Executive Directors, the new product lowers energy consumption as well as costs incurred in the construction and use of buildings. Although the global economic crisis has had an adverse effect on the construction sector, the global requirement for energy-efficient products will always rise. Projects that involve retrofitting thermal insulation in old buildings or cooling newer buildings require energy-efficient insulation materials.

Brudermuller said the worldwide market for EPS in the construction sector will continue to rise by about 5 percent each year. Rising energy prices and statutory regulations are two factors that are driving up the demand for EPS. About 70 percent of all EPS-based insulating materials in Germany are used in renovation projects while about 30 percent are used in new buildings. The use of EPS-based insulating materials in renovation projects is expected to increase to 75 percent by 2012.

Neopor is a more refined version of BASF's earlier EPS products. Special graphite particles, which lend it a gray appearance, act like mirrors and reflect thermal radiation. Therefore, heat loss is reduced in buildings with the use of smaller quantities of the product to achieve higher insulating effects. Users foam the granules and integrate them with the molded parts and insulating panels that are used to insulate roofs, exterior walls, and floors. The new EPS product can save about 30 percent of the energy required to cool buildings in hot climates. It is also used for effective sound insulation.

The thermal insulating and shock absorbing properties of EPS make it an attractive product in the construction and packaging industries. Low weight, high compressive strength, and moisture resistance are other properties of EPS products. Besides being used in buildings, EPS materials are also used in drainage, road construction, and bridges.

For buildings that cannot be equipped with external thermal insulation, internal insulation is commonly used to quickly heat up or cool down spaces and for short periods of time. For new construction and renovation projects, external insulation systems are very effective, both functionally and economically. Such systems protect the inner load-bearing shell or the exterior wall against thermal loads. They provide excellent protection against the weather as well.

Eastman Chemical Company announced it is taking additional actions to further reduce costs by more than $100 million in response to the ongoing global economic recession. These actions, in addition to those announced in December, increase Eastman’s expected total cost savings in 2009 to more than $200 million.

To implement these savings, Eastman is reducing base pay for U.S. employees by 5 percent effective March 30, 2009, with equivalent cost reductions in bargaining unit sites and locations outside the U.S. They are also implementing a global targeted reduction in work force of between 200-300 employees within the next 4-6 weeks. They plan to reduce non-critical maintenance costs, logistics costs and discretionary spending.

In addition to taking actions to reduce costs, the company lowered its budgeted 2009 capital expenditures to between $300 and $350 million. The company also expects to generate approximately $100 million of cash from working capital in 2009, assuming continued difficult economic conditions and raw material and energy costs similar to current levels.

Air Liquide SA, France, a global leader in the production of industrial gases, recently commenced operations at two new industrial gas plants in Sohar and Muscat in the Sultanate of Oman. The plants will cater to the increasing demand for gases from the country's booming petrochemical and industrial sector.

The two new air-separation plants were built by Air Liquide Sohar Industrial Gases LLC Muscat, a local subsidiary of Air Liquide. With the recent launch, ALSIG now operates three industrial gas plants in Oman, including an existing facility at the Sohar Industrial Port. The firm has doubled overall production capacity in the country from 200 tons per day to 400 tons per day of industrial gases.

Sohar is undergoing a rapid pace of industrialization and has a high concentration of diversified manufacturing companies. Nitrogen is a key component of industrial operations in these units. ALSIG's facility in Sohar supplies nitrogen and other gases through a dedicated pipeline network to industries in the region such as Sohar Refinery Company and Oman Polypropylene LLC. ALSIG's new plant in Muscat is located on the premises of the Mina al Fahal facility of Oman Refineries & Petrochemicals Company LLC.

Octal Petrochemicals, Oman, a leading producer of polyethylene terephtalate (PET) and amorphous PET in the Middle East, entered into an agreement with the authorities of the Port of Salalah in Oman to develop a $50 million liquids terminal and storage facility, the first of its kind in the region. The proposed "tank farm" will enable the firm to source large quantities of raw materials from the Middle East at the lowest possible cost.

According to the agreement, Octal will have a dedicated deep-water berth to receive tanker shipments of feedstock chemicals and its own storage facilities. The company will also have specialized underground pipeline transportation facilities over a distance of 1,000 meters to supply liquid chemicals via the tank farm to its Sapphire PET-manufacturing unit in the Salalah Free Zone.

The tank-farm project was first announced in February 2008. Octal has already completed the first phase of the terminal, which includes the development of two stainless steel tanks designed to receive monoethylene glycol, a key raw material in the manufacture of PET. While earlier reports indicate that each tank will have a storage capacity of 5,000 tons, more recent reports cite figures of 5,000 cubic meters.

The second phase of the project will involve the development of a third monoethylene glycol tank of similar capacity. Tenders for the second phase of the project were to be floated in September 2008, and the third MEG tank was scheduled to be developed by September 2009. The third tank is now slated for development by mid-2010. The third phase of the project will see the development of six tanks of similar capacity for receipt and storage of other liquid chemicals. The entire tank farm, comprising nine tanks, will be developed by 2011.

Stainless steel for the proposed tank farm is being imported from China. The tanks are being designed in Germany. The supply-processing equipment including pipelines, cables and electrical accessories are also being procured from Germany. Fluor Corporation, Texas, an engineering, procurement and construction services firm, is the technical advisor and project manager for the upcoming terminal.

The agreement also covers the lease terms for the land on which the terminal is being developed. A land area of 10,600 square meters has been earmarked for Octal's tank farm at the Port of Salalah. The piping and supporting transportation infrastructure for the terminal have already been developed and are currently in operation.

Established in 2006, Octal Petrochemicals is a subsidiary of Octal Holding and Company SAOC (Muscat). In late 2006, Octal commissioned a PET sheet plant in the Salalah Free Zone, the first manufacturing unit to be developed in the region. The plant has a manufacturing capacity of 150,000 tons per year of PET resin and 180,000 tons per year of PET sheet. In January 2009, the firm commissioned its second PET plant in the region. The integrated PET resin and sheet facility has a capacity of 300,000 tons per year, making it the largest PET resin facility in the Middle East and the world's largest clear rigid PET sheet manufacturing unit. Octal shipped its first orders of PET resin to Europe in January and expects sales to reach $400 million in 2009. The company is planning to further increase production capacity by 2011. While the first unit was set up with an initial investment of $350 million, the ongoing expansion is likely to increase total investments in the facility to $1 billion by 2011.

The tank-farm project will support the capacity expansion activities being undertaken by Octal, which hopes to become the largest manufacturer of PET resin in the Middle East and capture 20 percent of the global market for amorphous PET sheets, valued at $2.25 billion. Octal will primarily target the food and consumer packaging markets of the U.S., Europe and China for exports.

The terminal facility is also expected to enhance the image of the Port of Salalah as a regional cargo hub. Located in West-Central Asia, the region is strategically situated at the heart of the Indian Ocean Rim along the major East-West shipping lanes. The port provides connectivity to the Middle East, East Africa and the Indian subcontinent. The Port of Salalah is the largest port in Oman being developed with the largest private investment in the region.

Merck & Co. is buying Schering-Plough Corp. for $41.1 billion in stock and cash in a deal that will give the companies a competitive edge in a drug industry facing lower sales, tough generic competition and intense pricing pressures, reported by the Associated Press. The announcement will unite the maker of asthma drug Singulair with the maker of allergy medicine Nasonex and form the world's second-largest prescription drugmaker. Merck and Schering are already partners in a pair of popular cholesterol fighters, Vytorin and Zetia.

Big companies across the pharmaceutical industry are facing slumping sales as the blockbuster drugs of the 1990s lose patent protection, complicated by a dearth of major new drugs coming on the market. Merck and Schering-Plough, along with most of their rivals, are currently eliminating thousands of jobs and restructuring operations to further cuts costs. The two companies had a combined $47 billion in revenue in 2008. Merck has about 55,200 employees and Schering-Plough, which grew significantly with its November 2007 acquisition of Dutch biopharmaceutical company Organon BioSciences NV, has about 50,800 employees.

The two New Jersey pharmaceutical companies said that Merck’s Chairman and CEO Richard Clark will lead the combined company. The transaction is to be structured as a reverse merger. As a result, Schering-Plough will be the surviving corporation but will be take the name Merck. The new company will be based at Merck's Whitehouse Station, N.J. headquarters, but said that the majority of employees of Kenilworth, N.J.-based Schering-Plough will remain with the combined company. Merck executives believe that with Schering-Plough as the surviving company, under its partnership with New Jersey neighbor Johnson &Johnson, the change-in-control provisions should not be triggered. The companies said this will improve their finances, giving them annual cost savings of about $3.5 billion each year after 2011, and will boost earnings per share in the first full year after the deal closes.

Arch Chemicals, Inc. announced the release of its latest product – Proxel® BZ Plus preservative.

This product offers a dual mode of action, utilizing the proven technologies of Proxel preservatives and Omadine® microbiostats to inhibit microbial growth in latex emulsions, water-based paints, pigment dispersions, tape joint compounds, adhesives and aqueous mineral slurries. Additionally, it prevents discoloration in treated solutions, extends their shelf life and protects them from mold, mildew, fungus and bacteria.

Proxel BZ Plus preservative is a blend of the 1,2-Benzisothiazolin-3-one active agent in traditional Proxel products and zinc 2-pyridine-thiol-1-oxide from Arch’s Omadine biocides. There is currently a U.S. patent and foreign-counterpart applications pending for this product.

Headquartered in Norwalk, Connecticut, Arch Chemicals, Inc. says it is the world’s most comprehensive supplier of biocides. Its Industrial Biocides business, which is located in Smyrna, Georgia, offers numerous products for use in industrial end uses and health and hygiene applications.

Millipore Corporation announced that it has entered into an agreement to acquire Guava Technologies. The acquisition follows the distribution and co-development partnership the two companies announced in March 2008.

Under the terms of the agreement, Millipore will pay $22.6 million, subject to closing adjustments, to acquire Guava. Guava generated approximately $22 million in sales during 2008. The transaction is expected to be slightly accretive to Millipore’s non-GAAP earnings per share during 2009 and was expected to close in February.

“The acquisition of Guava represents another step forward in the transformation of our Bioscience Division,” said Martin Madaus, Chairman & CEO of Millipore. “Over the past three years, Millipore has become a life science leader with the product breadth and expertise to create platform solutions that enable our customers to work more efficiently. With the Guava acquisition, we will bring the power of our flow cytometry platform to all cell biologists by combining Guava’s instruments with our broad range of fully-validated reagent kits.”

McIlvaine Company

Northfield, IL 60093-2743

Tel: 847-784-0012; Fax: 847-784-0061

E-mail: editor@mcilvainecompany.com

Website: www.mcilvainecompany.com