CHEMICAL INDUSTRY UPDATE

NOVEMBER 2007

TABLE OF CONTENTS

Chemical Production Regional Index, September 2007

Rohm and Haas Announce Increases in Prices

Clariant to End Chemical Production in Coventry, RI

PPG Acquires Coatings Resource Corporation

LyondellBasell Industries to be New Company Name

ExxonMobil Sees Chemical Industry Growth Opportunities in Middle East

China’s Sinofert to Buy 30 percent of Wengfu Chemical

Huntsman Opens US $40m Plant in Singapore

Carmel Olefins to Acquire 49 percent of a Petrochemicals Company in Europe

Iran`s Olefin 5 Petrochem Works to Become Operational Sept 2008

Total, Samsung Double Capacity at South Korea Site

Taiwan`s Formosa to Expand Textile Production in Vietnam

ExxonMobil Starts Building Second Petrochemical Plant in Singapore

PPG to Invest US $50m into Tianjin Facility

China Clean Energy Announces Record Third Quarter 2007 Results

Westlake Chemical Reports Third Quarter Results

PPG Reports Third Quarter Sales

UNITED STATES

UNITED STATES

Chemical Production Regional Index

Chemical Production Regional Index, September 2007

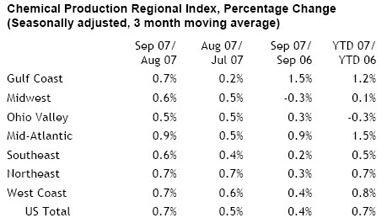

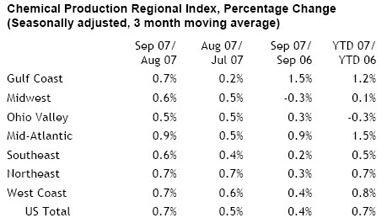

According to the American Chemistry Council (ACC), as measured by a three-month moving average, US chemical production rose by 0.7 percent in September, following a 0.5 percent gain in August. Chemical production activity posted monthly increases in all regions. To smooth month-to-month fluctuations, the chemical production regional index (CPRI) is measured using a three-month moving average.

Compared to September 2006, total US chemical production was up by 0.4 percent. Regionally, chemical production gained in every region except the Midwest region compared to a year ago. On a year-to-date basis, US chemical production was up 0.7 percent based on a three month moving average. Additionally, all regions except the Ohio Valley posted YTD increases.

Gulf Coast

Following a revised 0.2 percent increase in August, chemical production in the

Gulf Coast region gained a solid 0.7 percent in September. The Gulf Coast region

is dominated by the production of energy-intensive petrochemicals, inorganics,

and synthetic materials. The manufacture of these products depends on Gulf Coast

energy supplies as raw materials, as well as for fuel and power. On a

year-over-year basis, Gulf Coast chemical production was up 1.5 percent and was

up 1.2 percent on a year-to-date basis.

Midwest

In the Midwest region, which is influenced by production of agricultural

chemicals, plastics, paints, and other chemical products, chemical production

rose by 0.6 percent in September, following a 0.5 percent gain in August.

Compared to September 2006, Midwest chemical production in the region was down

by 0.3 percent, but up 0.1 percent on a year-to-date basis.

Ohio Valley

In the Ohio Valley region which is largely influenced by production of basic

chemicals, plastics and synthetic rubber, coatings, and consumer products,

chemical production gained 0.5 percent in September, following a 0.5 percent

rise in August. Compared to September 2006, production in the region was up by

0.3 percent, but was off 0.3 percent on a year-to-date basis.

Mid-Atlantic

In the Mid-Atlantic region, which is dominated by pharmaceutical manufacturing,

chemical production was up by a solid 0.9 percent in September, following a 0.5

percent gain in August. Mid-Atlantic chemical production was up 0.9 percent

compared to September 2006, and up 1.5 percent on a year-to-date basis.

Southeast

In the Southeast region, which is influenced heavily by production of basic

chemicals, fibers, agricultural and other chemical products, chemical production

increased by 0.6 percent September, following 0.4 percent growth in August.

Compared to September 2006, Southeast region chemical production was up by 0.2

percent, and up 0.5 percent on a year-to-date basis.

Northeast

In the Northeast region, also influenced by pharmaceutical manufacturing and

other specialty chemical manufacturing, chemical production gained 0.7 percent

in September, following a 0.7 percent gain during August. Compared to September

2006, Northeast region chemical production was up by 0.3 percent, and was up 0.7

percent on a year-to-date basis.

West

In the West region, chemical production rose by 0.7 percent in September,

following a revised 0.6 percent increase in August. Chemical production in the

West Coast region was up by 0.4 percent compared to a year ago, and was up 0.8

percent on a year-to-date basis.

Rohm and Haas Announce Increases in Prices

Rohm and Haas Announce Increases in Prices

Rohm and Haas Company (NYSE:ROH) announced it is seeking price increases for most of its chemical products, effective November 1, 2007. Increases will range from 5 to 15 percent.

“The costs of key raw materials – such as propylene, ethylene, methanol, as well as other raw materials like tin – have remained persistently high,” said Pierre Brondeau, Executive Vice President in charge of Specialty Materials. “Earlier in the year, there were strong indications that raw material prices would peak around mid-year, and then trail off during the second half of 2007. Given these expectations, we did whatever we could to use internal controls to mitigate the impact of the cost increases to Rohm and Haas, and selectively sought price increases in extreme conditions.

“However, raw material prices have not come down. In fact, they have continued to increase and have remained persistently high, with no real relief expected in the near future. To date, these increases have added more than $100 million to our raw material costs in total. Under these conditions, our only choice is to seek product price increases.” Brondeau continued, “I have directed each business segment in each geographic region to pursue the appropriate price increase with their customers, based on the escalation of raw materials and delivered costs for the products. We will be fair and reasonable with our customers, and know we can count on them for the same.”

Clariant to End Chemical Production in Coventry, RI

Clariant to End Chemical Production in Coventry, RI

Swiss specialty chemicals maker Clariant GmbH will end production at its Coventry facility by the end of 2008, but will keep the North American headquarters of its Pigment & Additives Division at the site, the company said recently.

The phaseout will affect about 120 workers, or 60 percent of the 200 people the firm currently employs in Coventry in manufacturing, support, technical, sales and marketing positions, Clariant said.

The phaseout comes at a time when global manufacturing capacity is shifting to Asia and other low-cost regions, promoting Clariant to address its own site network, Clariant Ltd.’s North American head, Ken Golder, said in a statement. It is part of a strategic plan announced by Clariant last November to optimize global capacity by closing about 10 percent of its 120 sites worldwide. Its announcement coincided with the release of the company’s third-quarter financial report, which showed profits declining despite increased cash flow.

The Coventry facility makes pigments used in coloring paints, inks, plastics and coatings for the automotive industry and other high-performance uses. It now manufactures about 15 percent of products purchased by the North American customers of the Pigment & Additives Division.

“Because of our excellent global production network and sources of supply,” Golder said, “Clariant can take on the production of these Coventry-made products at other locations.” Existing production lines at plants in Germany and Mexico will be adapted to accommodate Coventry’s proprietary processes, the company said.

“North America is the world’s largest pigment market, and we fully intend to build our business even further here and to increase market share,” said Bernhard Ehrenreich, the North American head of Clariant’s Pigment & Additives Division, adding: “The transfer of production of these pigment products to other locations should be transparent to our customers, as our service, distribution and logistical networks will remain intact.”

Meanwhile, company management has been informing local, state and federal officials about the decision to stop production at the site, Clariant said, and also has met with Rhodes Technologies, a tenant at the site since 1998.

The company also will be meeting with local economic development officials to pursue opportunities for redeveloping the 100-acre site, Hirschberg said. No timeline has been established for demolishing the existing buildings, where decommissioning and cleaning are expected to continue for several months after production ends next year, he said.

Ongoing environmental activities – including a groundwater remediation program currently in progress – will continue unabated, Hirschberg said.

Clariant GmbH is a developer and manufacturer of specialty chemicals for the global market. Based in Muttenz, Switzerland, near Basel, it employs about 21,500 people around the world. Clariant is organized into four divisions: Textile, Leather & Paper Chemicals; Pigments & Additives; Masterbatches; and Functional Chemicals.

PPG Acquires Coatings Resource Corporation

PPG Acquires Coatings Resource Corporation

PPG Industries (NYSE:PPG) announced it has acquired certain assets of Coatings Resource Corporation (CRC), Huntington Beach, Calif. Terms were not disclosed.

CRC produces paints, lacquers and varnishes for use on metal and wood industrial and consumer products, including audio-visual equipment, sporting goods and automotive interiors. It also produces injectable colorants, blowing agents, processing aids, ultraviolet (UV) stabilizers and anti-oxidants used on various types of plastics. CRC operates one manufacturing facility in Huntington Beach and employs approximately 30 people.

The acquired assets include inventory, accounts receivable, key sales and technical personnel, selected equipment, formulations and customer lists. CRC’s manufacturing plant in Huntington Beach will not be acquired by PPG but will toll manufacture products for PPG for the foreseeable future.

“This acquisition enables PPG to accelerate growth in key strategic markets for its industrial coatings business,” said William Wulfsohn, PPG senior vice president of coatings. “CRC’s extensive range of water-based and low-VOC (volatile organic compound) technologies will broaden PPG’s existing portfolio of environmentally responsible decorating solutions.”

CRC has supplied global plastic manufacturers with high-quality customized coating solutions for more than 30 years. The company’s waterborne technology enables the production of environmentally responsible products that perform to standards previously attained only with solvent-borne technology.

LyondellBasell Industries to be New Company Name

LyondellBasell Industries to be New Company Name

Basell and Lyondell Chemical Company (NYSE: LYO) jointly announced their plans for naming the company which will result from their planned merger. Following completion of the merger transaction, the newly combined company will be named LyondellBasell Industries.

"The new name will keep two well respected names in the forefront of the polyolefins, chemicals and refining industries," said Volker Trautz, Chief Executive Officer of Basell.

Both companies said that the LyondellBasell brand will be rolled out after the closure of the transaction, which is expected to take place in the fourth quarter 2007.

Basell is the global leader in polyolefin technology, production and marketing. It is the largest producer of polypropylene and advanced polyolefin products; a leading supplier of polyethylene and catalysts, and the industry leader in licensing polypropylene and polyethylene processes, including providing technical services for its proprietary technologies. Basell, together with its joint ventures, has manufacturing facilities in 19 countries and sells products in more than 120 countries. Basell is privately owned by Access Industries. (http://www.basell.com/)

Lyondell Chemical Company, headquartered in Houston, Texas, is North America's third-largest independent, publicly traded chemical company. Lyondell is a leading global manufacturer of chemicals and plastics, a refiner of heavy, high-sulfur crude oil and a significant producer of fuel products. Key products include ethylene, polyethylene, styrene, propylene, propylene oxide, gasoline, ultra low-sulfur diesel, MTBE and ETBE. (http://www.lyondell.com/)

INTERNATIONAL

ExxonMobil Sees Chemical Industry Growth Opportunities in Middle East

ExxonMobil Sees Chemical Industry Growth Opportunities in Middle East

ExxonMobil Chemical Company sees advantaged growth opportunities for the chemical industry in the Middle East. In remarks made at Arab-U.S. Policymakers Conference in Washington, D.C., ExxonMobil Chemical Company President Michael J. Dolan said that chemical industry investment can help the region generate the highest value out of its natural resources while building a thriving economy.

Speaking at this year’s conference, themed Revisiting Arab-U.S. Strategic Relations, he highlighted the fact that these growth opportunities are contingent on a policy environment that welcomes international trade and investment, and one that fosters global competition and free enterprise. In addition, Dolan emphasized that chemical industry investment brings well paying long-term jobs and multiplier effects on local economies, thereby enhancing overall economic growth.

Around the world, demand for chemicals is growing at a brisk pace — about two to three percent above world GDP.

“This high demand growth reflects the continued penetration of chemicals and plastics into end-product markets such as automotive, packaging, construction, and health and personal care,” said Dolan.

With large oil and natural gas reserves, Middle East nations are uniquely positioned to meet the rising demand for chemical products.

“The Middle East clearly enjoys an unparalleled advantaged energy and feedstock position,” said Dolan. “By integrating chemicals into the bigger resource management strategy, we see equally unparalleled opportunity for the region to benefit from proximity to growing markets in Asia.”

ChemChina Secures Nufarm

CHINA National Chemical Corp, backed by the world's biggest buyout fund Blackstone Group LP, agreed to pay A$3 billion (US$2.8 billion) in cash for Australia’s Nufarm Ltd to form the world's largest supplier of generic farm chemicals.

The offer by China National, known as ChemChina Group, values the Melbourne-based company at A$17.55 a share, 27 percent higher than its closing price on October 30, Nufarm said yesterday in a statement. The price includes the payment of a 30-cent-a-share dividend by Nufarm, it said.

ChemChina is the first state-owned Chinese company to team up with buyout firms for an overseas acquisition. Buying Nufarm gives ChemChina entry to the US$36-billion global market for herbicides and pesticides as a worldwide agricultural boom spurs acquisitions.

Nufarm, Australia's biggest supplier of farm chemicals, rose A$1.74, or 11 percent, to A$17.34 at the Sydney close on the Australian Stock Exchange. The offer price, excluding the proposed dividend, is A$17.25.

ChemChina, the largest producer of pesticides in China, will gain a company that has manufacturing operations in 14 nations and sells its products into 100 countries.

China’s Sinofert to Buy 30 percent of Wengfu Chemical

China’s Sinofert to Buy 30 percent of Wengfu Chemical

China's largest fertilizer importer Sinofert Holdings Ltd. (SEHK: 0297) has signed an agreement to purchase a 30 percent stake in Gansu Wengfu Chemical Co., Ltd., the biggest phosphate fertilizer producer in Northwestern China.

After the deal worth CNY 23.4 million, Guizhou Wengfu Chemi-Phos Imp. & Exp. Corp. and Gansu Chemical Industry (Group) Co., Ltd. will own 40 and 30 percent respectively of Wengfu Chemical.

Sinofert Chairman Xu Keping told journalists that they hoped to join hands with Guizhou Wengfu and Gansu Chemical and make use of their own advantages to set up the biggest phosphate fertilizer project in Northwestern China. The northwestern regions, the country's important agricultural areas, have been a major consumption of chemical fertilizers, especially phosphate fertilizer, the chairman stressed.

Guizhou Wengfu is one of the country's largest phosphate fertilizer producers, its chairman He Haoming said, and Sinofert is the country's biggest comprehensive chemical fertilizer. The fresh cooperation will further their strategic partnership and enable them to contribute more to the sustainable development of the Chinese chemical fertilizer industry, in particular of the phosphate fertilizer sector, the chairman predicted.

Wengfu Chemical, formed in November 2006, owns an 800,000- ton ore-dressing project and is capable of turning out 180,000- ton diammonium phosphate a year.

This June, the company invested to build a phosphoric acid project with a yearly production of 100,000 tons and the second phase upgrading project with a designed diammonium phosphate output of 240,000 tons annually.

After the projects are finished, it is expected to have a total diammonium phosphate production capacity of 420,000 tons and reach an annual production value of CNY 800 million, ranking first among phosphate fertilizer producers in Northwestern China.

In recent years, Sinofert, previously known as Sinochem Hong Kong Holdings Ltd., has been extending its reach in Mainland China. Last year, the Hong Kong-listed company bought into Shandong Luxi Chemical Co., Ltd. (SZSE: 000830) and Shandong Hualu-Hengsheng Chemical Co., Ltd. (SHSE: 600426).

For the moment, Sinofert has become Luxi Chemical's third largest shareholder with a stake of 4.78 percent or 50 million restricted shares, and Hualu-Hengsheng Chemical's second largest shareholder with 15 million restricted shares, accounting for 4.54 percent of its capital stock.

Earlier this year, it invested in Henan Xinlianxin Fertiliser Limited Company. On October 17, it obtained from its effective controller Sinochem Corp. 18.49 percent shares of Qinghai Salt Lake Potash Co., Ltd. (SZSE: 000792).

Global Chemical Producer Huntsman Opens US $40m Plant in Singapore

Huntsman Opens US $40m Plant in Singapore

Global chemical producer Huntsman Corp has opened a polyetheramine manufacturing plant in Singapore. The US $40 million facility will be the first of a new wave of investments by the company in Asia. The firm is also seeking a greater presence in the region to meet growing demand. The new plant marks a key step in Huntsman Corp's expansion into the Asia Pacific region.

Jon Huntsman, Chairman of Huntsman Corp, said: "Today, 75 percent of our growth is outside US, and the bulk of it is in Asia Pacific. We've always had a presence in Singapore and felt that this would be the ideal place to develop our main base of operation and then move out to other areas in Asia Pacific.

"We have many plants planned for the Asia Pacific area because that's where the growth of the world is."

Huntsman plans to hire 20 percent more staff in the Asia Pacific by 2008, to hit 3,000 employees. That will include staff numbers for its plants here in Singapore.

"We hope to continue to grow our current site. Our facility is geared for growth. Jurong Island is a special place, particularly for manufacturing, industrial and more specifically, chemical businesses," said Hunt.

Singapore's chemical cluster output grew by 12 percent in 2006 to exceed S $74 billion.

Speaking at the opening ceremony of the new plant on Wednesday, Trade & Industry Minister Lim Hng Kiang noted that with further investments in the pipeline for the sector, sentiment is buoyant.

"The gain in mass and aggregation of upstream molecules set the stage for development of high value downstream chemical industry," said the minister.

The new plant is also seen as a key step into a new growth phase for Singapore's maturing chemicals cluster.

Acquisitions in Japan

Chemical & Engineering News recently reported Industrial Equity Investments Limited (IEIL), a unit of London-based Permira Advisers, agreed to acquire Arysta LifeScience, the Tokyo-based agricultural chemicals firm, for about $2.2 billion. And Kirin, one of Japan's largest brewers, is offering $2.6 billion to acquire a majority of drugmaker Kyowa Hakko Kogyo.

Olympus has built Arysta to the number-10 position in crop protection worldwide.Arysta, the world's 10th-largest crop protection company, with 2006 sales of about $1 billion, was put up for auction earlier this year by its owner, U.K. private equity firm Olympus Capital. Olympus first invested in Arysta in 2002, partnering with Tomen and Nichimen, which had previously formed Arysta by merging their agchem operations. The Japanese firms sold their shares to Olympus earlier this year.

Olympus says Arysta's profitability doubled under its ownership. "Olympus Capital has consistently supported Arysta's growth plan," adds Arysta CEO Christopher Richards. "We are confident that we will have IEIL's ongoing support."

Meanwhile, for beer maker Kirin, purchasing a drug company may seem like a stretch, but it's not. Kirin already has a pharmaceuticals division that posted 2006 sales of $590 million. The company, which has extensive fermentation expertise, has commercialized a number of drugs and is researching antibody-based treatments.

With sales of $3.1 billion in its latest fiscal year, Kyowa markets a range of prescription drugs in Japan. It also produces amino acids, food ingredients, and industrial chemicals. Kirin and Kyowa say a merger will increase cost-efficiency and boost their research capabilities.

Carmel Olefins to Acquire 49 percent of a Petrochemicals Company in Europe

Carmel Olefins to Acquire 49 percent of a Petrochemicals Company in Europe

Carmel Olefins has signed an MOU to acquire 49% stake in a European petrochemicals company for €20 million. The name of the company has not been disclosed. As per the terms of the MOU, Carmel Olefins might also pay up to an additional €1 million a year for five years beginning in 2013. Carmel Olefins is equally owned by Israel Petrochemical Enterprises Ltd. and Oil Refineries Ltd.

Iran`s Olefin 5 Petrochem Works to Become Operational Sept 2008

Iran`s Olefin 5 Petrochem Works to Become Operational Sept 2008

Morvarid Petrochemical Complex Managing Director Safar-Ali Babaei said Olefin 5 would come on stream in September 2008.

"Engineering works of Olefin 5 started on April 25, 2006 and furnaces were installed late September of the same year".

Babaei said phases 9 and 10 of South Pars field would provide the feedstock of Olefin 5, adding the two phases would be put into operation by early 2008 and the complex would face no feedstock problem.

"Such a progress is a record in petrochemical sector," boasted the managing director, saying time management in the construction of Olefin 5 helped accelerate the running of the unit, set a new record, and slash executives costs considerably.

Jam Petrochemical Company's Olefin Unit, the largest in the world, would also become operational in Pars Special Economic Energy Zone (Assalouyeh) in southern Iran by March 19, 2008, said the company managing director.

Hassan Beigi added the Olefin Unit would meet the feedstock of other units of the company.

He said other units of the company had experienced pilot production process and were undergoing the official production stage.

"Olefin 10 has totally made 97.88 percent progress," said Beigi, adding the preliminary construction operations of the unit started in mid-2001 and two billion dollars had been invested in the project.

Olefin 10 is one of the most lucrative projects of the petrochemical industry, which aims to produce one million tons of polymers, some 1.5 tons of ethylene and propylene, and about one million tons of chemical and petrochemical products.

Of products, less than 10 percent is used by domestic industries and the remaining is exported abroad.

Source: Asia Pulse Pte Ltd.

Total, Samsung Double Capacity at South Korea Site

Total, Samsung Double Capacity at South Korea Site

Total SA and Samsung General Chemicals Co Ltd have raised the capacity of their jv polypropylene plant in Daesan, South Korea, by more than twofold to 1.2 bn lbs/y. The project entailed adding 661 M lbs of PP capacity and upgrading the site's ethylene naphtha plant to raise capacity to 1.8 bn lbs/y from 1.3 bn lbs/y.

The Daesan jv is called Samsung Total Petrochemicals Co Ltd. The companies also announced the conclusion of a modernization project for the site's styrene monomer production. It involved increasing one monomer unit's output from 838 M lbs/y to 1.3 bn lbs/y. The site now has a total styrene monomer capacity of 1.9 bn lbs.

Taiwan`s Formosa to Expand Textile Production in Vietnam

Taiwan`s Formosa to Expand Textile Production in Vietnam

Taiwan's Formosa Chemicals and Fibre Corp will invest 10 billion Taiwanese dollars (US$309 million) on expanding its textile base in Vietnam, the Economic Daily News in Taiwan reported.

The investment, scheduled to begin operations in 2009, aims to add nylon fibre and yarn production, the paper said, adding that the project is expected to encourage Taiwanese downstream textile manufacturers to follow suit and form a production cluster in the area.

Formosa Chemicals and Fibre Corp, a unit of Taiwan's petrochemical conglomerate Formosa Plastics group (TAIEX:1301), currently operates a joint venture textile production complex near Ho Chi Minh City.

ExxonMobil Starts Building Second Petrochemical Plant in Singapore

ExxonMobil Starts Building Second Petrochemical Plant in Singapore

The American petrochemicals giant ExxonMobil started building its second petrochemical plant in Singapore. The project is expected to come on-stream in early 2011. A ground breaking ceremony was held on Jurong Island, next to the company's existing petrochemical project.

The new petrochemical project will produce 1 million ton-a-year of ethylene, and 450,000 ton-a-year of polypropylene, as well as 300,000 tons of specialty elastomers.

Singapore Prime Minister Lee Hsien Loong said at the ceremony that ExxonMobil's decision to embark on its second chemical plant here reflects its confidence that Singapore will continue to provide a stable and conducive business environment over the long- term. He also pointed out that it will further boost to the city- state's position as a regional chemical industrial base for the world's leading players.

The output of the entire chemicals cluster is now 74 billion Singapore dollars (about 51 billion U.S. dollars).

PPG to Pour US $50m into Tianjin Facility

PPG to Invest US $50m into Tianjin Facility

China Daily reports leading coatings manufacturer PPG Industries Inc said it will spend US$50 million to expand output to 100,000 tons a year at its Tianjin plant.

The company plans to expand the Tianjin Economic and Technological Development Area (TEDA) facility from 40,000 to 100,000 sqm to meet the nation's growing demand for automotive and industrial coatings.

PPG will spend US$10 million on the new project in the first phase and around US$40 million in the second. Total investment in the facility is expected to reach US$100 million.

Production capacity for automotive and industrial coatings will increase from 60,000 tons to more than 100,000 tons per year when the project is complete.

"Airbus, Motorola and some local automotive companies are PPG's key customers," said Viktor R Sekmakas, vice-president of the Asia-Pacific region for PPG. "The new project will address PPG's urgent need to expand production, better satisfy customer demand and help PPG to maintain its rapid development."

PPG will also set up a research and development center in the second phase at the Tianjin facility, focusing on environmentally friendly products and local services.

"The Tianjin plant will continue to be PPG's largest production facility in the Asia-Pacific region. Its success has given us continued confidence to invest in China as well as in the Asia-Pacific region," said William A Wulfsohn, senior vice-president of PPG.

PPG said it sees the Tianjin facility as a base for further development in the Asia-Pacific region.

"Tianjin is an important engine that has been driving our overall growth in China. Expanding the plant here will help PPG provide value-added services to some of our key customers in Tianjin, such as Airbus," said Sekmakas.

PPG set up its coatings business in China in 1994. The Tianjin facility was its first investment in the nation. In September, PPG had revenue of US$100 million for a single month, 23 percent of which came from the Tianjin area.

FINANCIALS

China Clean Energy Announces Record Third Quarter 2007 Results

China Clean Energy Announces Record Third Quarter 2007 Results

China Clean Energy Inc. (''China Clean Energy'', the ''Company''), a leading producer of biodiesel fuel and environmentally- friendly specialty chemical products made from renewable resources in The People's Republic of China (''PRC''), reported record financial results for the third quarter ended on September 30, 2007.

Third Quarter 2007 Highlights

-- Revenue reached a record $5.5 million, up 48% from the third quarter of 2006

-- Gross Profits reached a record $ 1.4 million, up 37% from the third quarter of 2006

-- Operating Income totaled $861,257, up 9% from the third quarter of 2006

-- Net Income was $834,586, or $0.04 per share, up 67% from the third quarter of 2006

''We continued to see strong demand for our biodiesel as well as our specialty chemical products as we benefited from our capacity expansion in the first half of the year,'' said Mr. Tai-ming Ou, Chairman and CEO of the Company, ''We also made significant progress towards the build-out of our new 100,000 tons, or 30 million gallons per annum, biodiesel plant in Jiangyin and as of today have completed the approval process and received our business license, with construction work now expected to start in the fourth quarter of 2007 and production start-up expected during the fourth quarter of 2008."

Westlake Chemical Reports Third Quarter Results

Westlake Chemical Reports Third Quarter Results

Westlake Chemical Corporation recently reported net income of $38.3 million, or $0.59 per diluted share, for the third quarter of 2007. This represents a decrease from the third quarter of 2006 net income of $61.7 million, or $0.95 per diluted share. Sales for the third quarter of 2007 were $840.2 million and income from operations for the third quarter of 2007 was $59.8 million. This compares with net sales of $672.4 million and income from operations of $87.0 million in the third quarter 2006. The increase in sales is the result of higher polyethylene sales volumes attributable to the November 30, 2006 acquisition of Eastman Chemical's polyethylene business in Longview, Texas. The decline in income from operations was primarily due to weakness in the Vinyls segment, particularly the downstream products businesses, which was impacted by the slowdown in the residential construction market. Margins remained at low levels primarily due to rising feedstock costs and the vinyls industry's inability to raise prices to cover these cost increases.

PPG Reports Third Quarter Sales

PPG Reports Third Quarter Sales

PPG Industries (NYSE:PPG) reported record sales for the third quarter of $2.8 billion, surpassing the prior year’s third quarter results by 13 percent. Third quarter net income was $191 million, or $1.15 per share, and was comprised of net income from continuing operations of $215 million, or $1.29 per share, and a loss from discontinued operations, net of tax, of $24 million, or 14 cents per share.

PPG reported in September 2007 the signing of agreements to sell its two automotive glass businesses and its fine chemicals business. Those transactions are expected to be completed in the fourth quarter 2007. Consequently, the results of operations for those businesses for the current and prior periods will be reported as discontinued operations in a separate component of PPG’s earnings in accordance with generally accepted accounting principles.

PPG’s sales for the third quarter of 2006 were $2.5 billion. Third quarter net income was $90 million, or 54 cents per share, and was comprised of net income from continuing operations of $70 million, or 42 cents per share, and income from discontinued operations, net of tax, of $20 million, or 12 cents per share. Net income from continuing operations included aftertax charges of $106 million, or 64 cents per share, for legacy environmental remediation costs; $21 million, or 12 cents per share, for legal settlements; and $4 million, or 2 cents per share, for the proposed asbestos settlement. Net income from continuing operations also included aftertax earnings of $7 million, or 4 cents per share, for an insurance recovery. Adjusted net income from continuing operations was $194 million, or $1.16 per share.

“Our continuing operations delivered double-digit sales growth and a 15 percent increase in adjusted earnings per share,” said Charles E. Bunch, PPG’s chairman and chief executive officer. “Achieving this strong financial performance despite a slowing North American economy is largely a result of the successful execution of our strategies over the past few years to rapidly grow the specialty businesses in our portfolio and expand our global presence.”

Bunch noted that both of PPG’s coatings segments and its Optical and Specialty Products segment all reached third quarter sales records, and all of PPG’s business segments improved earnings by at least 4 percent year over year.

McIlvaine Company

Northfield, IL 60093-2743

Tel: 847-784-0012; Fax: 847-784-0061

E-mail: editor@mcilvainecompany.com

Web site: www.mcilvainecompany.com