Severe Service Valve Market is Large and Challenging

McIlvaine Company is conducting extensive analyses of severe service valves for

applications in many industries. Initially, we focused on the definition and one

application (molecular sieves switching valves). Here is a summary of the

analysis and a link to the full analysis.

http://www.mcilvainecompany.com/Decision_Tree/subscriber/Severe_Service_Valve_04_14_16.pdf

There are many difficult applications for valves. High temperatures, abrasive

solids, corrosive fluids, and rapid cycling are just some of the conditions

which challenge the industry. Both isolation and control valves must be designed

appropriately. The valve industry has referred to these applications as “Severe

Service.” The problem is that there is no precision relative to the definition.

The annual market for these valves is anywhere from $6 to $14 billion/yr.

depending upon how you define SSV. As a result, we are working with the industry

to obtain consensus. We were delighted to learn that Ross Waters president of

CGIS has been active in defining severe service valves. His company has

extensive and lengthy experience in the supply of severe service valves in

multiple industries in various countries. We interviewed him on the subject and

obtained some insightful answers.

We then chose one application:

molecular sieve switching valves to serve as an example.

Historically the rising stem ball valve (RSBV) has been used in this

application. But the selection is complicated and depends to some extent on the

severe conditions. Flowserve generalizes that this valve with its

friction-free linear movement and mechanically energized metal seat has proven

it to be the most suitable design for optimal long-term performance in severe

applications, Cameron also recommends the rising stem ball valve. Cameron

says it provides tight shutoff, withstands frequent cycling, and handles high

temperatures better than other valve types in this service.

ValvTecnologies draws some different conclusions based on specific experiences.

They say that more long-term success has been realized with metal seated quarter

turn ball valves and can cite installations were the rising stem ball valves

have been replaced. ValvTechnologies’ zero-leakage carbide coated metal seated

ball valves were selected and installed for a major operator’s sour gas plant in

Monkman, British Columbia, replacing rising stem ball valves that lasted one

year in service. These valves feature the same design proven since

ValvTechnologies’ produced the seat supported fixed ball design.

The first installation in a molecular sieve lasted eight years after its initial

installation, providing severe service zero-leakage isolation. Given a

conservative one day shut-down per year to replace other designed valves in a

plant processing 220mmcfd of saleable gas at $750,000 per day, that is $6.0Min

improved efficiency over the course of eight years.

International Strategy is Critical for Survival in the Flow Control and

Treatment Industries

Whether you sell pumps, valves, filters, fans, compressors, treatment chemicals,

scrubbers or centrifuges, you cannot focus on just the U.S., China, or EU

market. Here are some examples of major opportunities elsewhere:

|

Industry

|

Country

|

|

Aquaculture

|

Indonesia

|

|

Bauxite

|

Kazakhstan

|

|

Cement

|

Turkey

|

|

Coal-fired power

|

Vietnam

|

|

Coal mining

|

Columbia

|

|

Copper

|

Chile

|

|

Desalination

|

Israel

|

|

Flat Panels

|

South Korea

|

|

Gas Extraction

|

Nigeria

|

|

Iron Ore

|

Ukraine

|

|

LNG

|

Australia

|

|

Pharmaceuticals

|

India

|

|

Petrochemicals

|

Saudi Arabia

|

|

Phosphate

|

Morocco

|

|

Pulp/Paper

|

Brazil

|

|

Potash

|

Canada

|

|

Refineries

|

Algeria

|

|

Semiconductors

|

Taiwan

|

|

Steel

|

UAE

|

The U.S. has placed a moratorium on new coal-fired power plants but China will

build far more than the EU or that the U.S. will retire. Vietnam, Indonesia

and Myanmar are building power plants with a combined capacity of 150,000 MW.

China is the largest fish farming country, but Indonesia is also large. The

industry is moving to sophisticated recirculating systems with a big investment

in flow control and treatment equipment.

Australia, a leader in iron ore and coal mining, has become a recent player in

LNG with successful conversion of coal bed methane.

Individual projects can measurably impact the market in a given year. There are

nine large Canadian potash projects underway with a combined capital investment

of over $30 billion. The largest project will require a $4 billion investment.

Algeria’s state-owned Sonatrach

has let a

series of contracts to Amec Foster Wheeler to provide front-end engineering and

design (FEED) for three grassroots refineries that will add a total of 15

million tons/year in refining capacity in the country. These few

projects represent a significant percentage of the yearly flow control and

treatment revenues for the worldwide industry.

Coal-fired projects in Indonesia could result in an investment of over $100

billion. Vietnam is vacillating on plans which would require a coal-fired power

plant investment of over $200 billion. Delay or cancellation of large projects

can materially affect the revenues of the flow control and treatment suppliers.

Flow control and treatment companies need to pursue the world market. There are

196 countries with more than 50 major industries who purchase flow control and

treatment equipment. Many of these countries are quite small. McIlvaine

forecasts divide the world into 80 purchasing entities which include 72 separate

countries and 8 country groups. The pump forecast example below shows pump sales

in Pakistan will be $216 million in 2021, but sales will only be $22 million in

a group of countries labeled “Other Western Europe.”

|

Industrial Pump 2021 Revenues

|

|

Country or Entity

|

Revenues

$ Billions

|

|

New Zealand

|

69.51

|

|

Nigeria

|

411.34

|

|

Norway

|

283.79

|

|

Other Africa

|

775.41

|

|

Other CIS

|

198.22

|

|

Other East Asia

|

89.62

|

|

Other Eastern Europe

|

108.45

|

|

Other Middle East

|

825.15

|

|

Other South & Central America

|

462.79

|

|

Other West Asia

|

14.15

|

|

Other Western Europe

|

21.90

|

|

Pakistan

|

216.54

|

|

Peru

|

165.93

|

|

Philippines

|

260.63

|

|

Poland

|

377.89

|

The countries aggregated in the Other Western Europe category are Andorra, Faroe

Islands, Gibraltar, Greenland, Guernsey, Iceland, Isle of Man, Jersey,

Lichtenstein, Luxembourg, Malta, Monaco, San Marino and Vatican.

The average for the 80 entities in a $60 billion annual market is 0.75 percent.

While, as individual countries, many in the “other” category are insignificant,

as a group they are relevant. This is particularly true for the Other Africa

group which accounts for 0.75 percent of the total market and the Other Middle

East group which in the aggregate is bigger than the average.

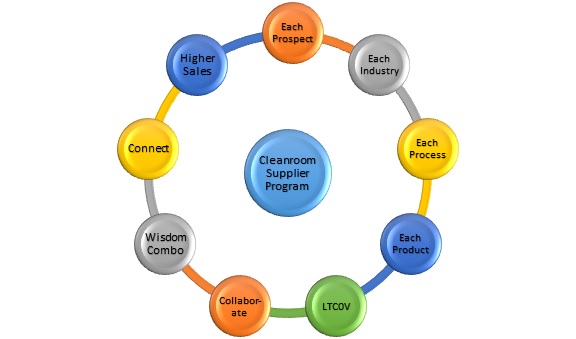

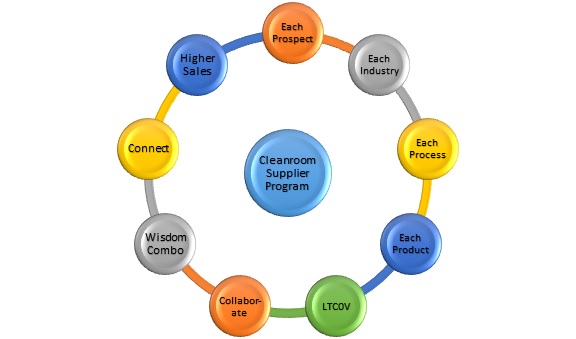

McIlvaine has created a program to help international flow control and treatment

suppliers maximize the global opportunity. It is described at:

Detailed Forecasting of Markets, Prospects and Projects

Bob McIlvaine is available to answer your questions and can be reached at

847-784-0012 ext. 112

rmcilvaine@mcilvainecompany.com

$14 Trillion to be spent on Power Plant Equipment and Repairs in the Next 25

Years

Electricity production will be up 100 percent by 2040. This will require an

investment of $14 trillion in new hardware and repair parts for existing

equipment and systems. Coal-fired generation will grow by 10 percent. One would,

therefore, expect that investment in coal-fired power generation would be less

than in other technologies. However, when you take into account repair and

upgrades, coal-fired power will require more in investment than any of the

alternatives.

World coal powered generation capacity is 2.2 million MW today and is slated to

rise by only 10 percent or only 200,000 MW during the next 25 years. The

investment needed to keep an old power plant running from age 50 to age 75 and

to be upgraded to the likely emission limits, will be nearly equal to the $2

million/MW cost of a new power plant over a 25 year period. This means that $4.4

trillion will need to be invested in coal-fired power. Much of that will be in

Asia where many new power plants will be built. Net capacity will drop in Europe

and the U.S. This does not mean that the two areas will not be spending money on

coal-fired power plants. The U.S. moratorium on new coal-fired power plants and

the necessity to maintain 200,000 MW of coal-fired capacity means that the U.S.

will have to spend $400 billion just to keep the old power plants running and

meet increasingly stringent environmental standards.

|

Power Plant Investment

2015-2040

|

|

Generator Type

|

$ Trillions

|

|

Coal-fired Power

|

4.4

|

|

Gas Turbine Combined Cycle

|

2.2

|

|

Nuclear

|

2.0

|

|

Biomass

|

0.6

|

|

Wind

|

2.3

|

|

Solar

|

2.8

|

|

Total

|

14.3

|

Nuclear capacity is slated to increase from 392 GW in 2013 to more than 620 GW

in 2040. But its share of global power generation will rise just one percentage

point to 12 percent, because almost 200 reactors of the 434 operational at the

end of 2013 will be retired, they will need to be offset by new power plants.

Total investment will exceed $2 trillion over the next 25 years.

The gas turbine combined cycle power generation market will grow by more than

300 GW to over 2 million GW by 2040. Replacements, upgrades and retirements all

result in a net capital investment of $2.2 trillion.

Biomass capacity will be 300 GW in 2040. Wind capacity will be 1300 GW and solar

1000 GW.

By 2040 Chinese energy production will be twice that of the U.S. but per capital

consumption will still be only half that of the U.S. The gas turbine market in

China will be bolstered by the Chinese coal-to-gas program which will deliver

gasified coal to turbine generators throughout the country.

India today is home to one-sixth of the world’s population and is its

third-largest economy, but accounts for only 6 percent of global energy. Demand

for coal in power generation and industry will surge increasing the share of

coal to almost half of the energy mix and making India the largest source of

growth in global coal use. By 2040, Asia is projected to account for 80 percent

of coal consumed globally. Coal will remain the backbone of the power system in

many countries.

Many components of coal and gas turbine generating plants need to be replaced

frequently. Catalyst for a coal-fired power plant is replaced every 3-5 years

and every 10 years for a gas turbine power plant. Boiler feedwater valves will

be replaced more frequently in a gas turbine power plant due to the constant

cycling and phenomena such as Flow Accelerated Corrosion (FAC). Slurry pumps,

ball mills, fans and air pre-heaters in coal-fired power plants are in periodic

need of replacement parts. Both coal and gas turbine operators are now more

likely to use zero liquid discharge (ZLD) systems which are high maintenance

systems.

Coal-fired power plants are switching from electrostatic precipitators to fabric

filters. This results in biannual purchases of new bags. Gas turbine plants now

favor high efficiency inlet filters which are more expensive and need more

frequent replacement than the low efficiency alternative.

The power plant generation market was reviewed in a McIlvaine Hot Topic Hour on

April 7.

McIlvaine publishes market reports with detailed forecasts of the power market.

They include:

59EI Gas

Turbine and Combined Cycle Supplier Program

N043 Fossil

and Nuclear Power Generation: World Analysis and Forecast

42EI Utility

Tracking System

Flow Control and Treatment Companies will benefit from a Digital Crystal Ball

The digital age has created the ability to make fortune telling a reality. The

real life version of a crystal ball is the wealth of information available to

predict markets, projects and identify decision makers. This information can be

used to change the way flow control and treatment products are marketed.

Long range purchasing plans can be determined by an organized analysis of

information which can be obtained directly from available documents or through

individuals who have specific insights.

|

Minutes of municipality meetings

documenting engineering study

authorization

|

Consultant reports advising

course of action for companies

under public scrutiny

|

Permit applications for

construction or upgrading

|

|

Submittals to the World Bank and

other lending institutions

|

|

Five Year Plans for China and

other countries

|

|

Recent and pending regulations

which will impact the market

|

LinkedIn, blogs and various

online groups with willing

volunteers of information

|

Google and other search engines

|

The local salesman can make a call on a municipal wastewater treatment plant but

would be unlikely to provide the same value gained from the directors meeting

minutes which outline the failure of the competitor’s equipment and his proposal

to fix it.

The power plant modification permit request which details the cost and

performance of various options provides the needed insights on product and

timing for a potential supplier.

One way suppliers take advantage of the availability of information is to

purchase sales leads. Typically the

company spends lots of money on these leads and not on market research.

In one sense, the leads are the market research.

In fact, published studies purport to link the number of sales leads to

the size of future markets.

This approach has a number of undesirable aspects:

1.

The large expenditure for sales leads draws funds away from critical market

research.

2.

Sales leads are not qualified. High

margins and order conversion result from picking and choosing projects.

3.

Since the sales lead is also being viewed by the competitors, there will be

pricing pressure and lower success rates.

4.

The timing of sales leads is often right if you are selling a commodity, but if

you are selling based on your product differentiation, you are too late.

5.

Many companies have distributors and representatives who are being paid to

uncover leads. Sales lead expense

is justified based on evaluating distributor performance rather than on boosting

sales.

If you are selling a commodity, product and price is the basis of success then

the sales lead route is probably still the best option. But, if you sell a

product based on lowest cost of ownership and not initial price, then you should

consider a whole new route using the digital crystal ball.

Detailed Forecasting of Markets, Prospects and Projects

is your digital crystal ball because:

1.

Forecasts can be provided for the precise product at the State and province

level.

2.

Project alerts provide the time to convince the customer to consider total cost

of ownership and to issue bid specifications accordingly.

3.

The large end users, OEMs, and AEs are identified.

Since they purchase more than 50 percent of the flow control and

treatment equipment, the focus on them is critical.

4.

The opportunity to connect with the end user through white papers and webinars

improves the margin and success potential.

5.

The ability to demonstrate lowest cost of ownership is the secret to success in

the global market.

For more information on this program contact Bob McIlvaine 847-784-0012 ext. 112

rmcilvaine@mcilvainecompany.com

Bob McIlvaine

President

847-784-0012 ext. 112

rmcilvaine@mcilvainecompany.com

www.mcilvainecompany.com