Decision Options for Filters, Media, Components, Resins and Fibers

An April-May feature article in Filtration News by Bob McIlvaine of the

McIlvaine Company

Filtration purchasers and specifiers do not have to understand the chemistry,

physics, or other scientific aspects of filtration. All they have to do is find

the options which are available and determine the advantages and disadvantages

of each. Filtration News and

McIlvaine Company are teaming to provide this critical information in the range

of filter choices from resins through filter elements.

Four areas of immediate focus are hot gas filtration, gas turbine inlet

filtration, coalescing filters for oil and gas and reverse osmosis membranes.

The June –July issue of Filtration News

will be devoted to the options available in hot gas filtration. This article

will be based on analyses being posted to a free McIlvaine web site

Hot Gas

Filters - Continuous Analyses. The site covers the entire

hot gas decision making process. The sub-set of data focused on the resins

through filters will also be displayed on a special

Filtration News site. The

McIlvaine site will be most useful to end users and system suppliers. The

Filtration News site will be most

useful to those making the resin, fiber, component, and media decisions.

The world’s knowledge resides in small niches. Therefore, the classification

effort needs to involve the niche experts at each step along the way. The

determination of the best option is greatly enhanced by face-to-face debates and

discussions among experts. A third partner in this whole initiative is AFS

who will provide this interface at the AFS Filtration and Separations at the

Power Generation Conference on April 28-29th in Charlotte, NC.

A debate/discussion session on hot gas filtration options will be

conducted from 10 a.m. - 11:30 a.m. on Wednesday the 29th. This

will be preceded by relevant speeches on Tuesday the 28th.

Conclusions from that meeting will be reflected in the June article in

Filtration News.

The decision making process can be likened to a trip using GPS. When you take a

wrong turn, a voice tells you to recalibrate and provides new instructions.

In Hot Gas Filtration there will be lots of wrong turns and recalibration.

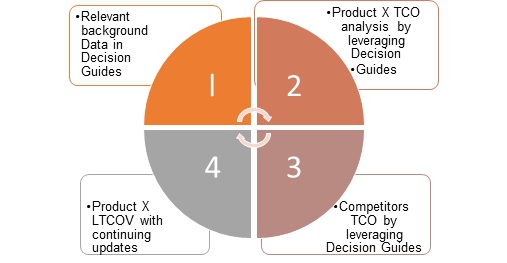

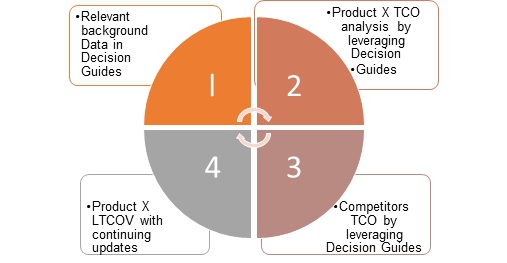

McIlvaine has coined the term Global Decisions Positioning System™ (GDPS) to

describe the whole trip back and forth among decision trees. Here is the GDPS

route for hot gas filter decisions in the power industry.

GDPS Route Map for Decisions Relative to Hot Gas Filtration for Power Plants

The decision relative to removing particles from the hot gas stream cannot be

made independent of conclusions reached in the other decision trees. Filters can

remove mercury and with sorbents can remove acid gases. The new catalytic

filters can also remove NOx. So the decision maker must travel

back and forth among the particulate, NOx, acid gas and air toxics

decision trees.

If you choose a filter which not only removes particulate but also acid gases

with sorbents, the resulting mix cannot be sold. So the power plant must decide

whether it wants to sell its flyash or lower capital cost with a combined

system.

Some filters will not tolerate the acid levels encountered with high sulfur

fuels. Does the power plant want to limit its ability to buy cheap fuels?

This may depend on the anticipated life of the plant. There are many new

regulations which could shorten the economic life of coal-fired power plants.

These regulation impacts have to be simultaneously evaluated.

One of the most worrisome regulatory threats is limitation of greenhouse gases.

The catalytic ceramic filter element will produce clean gas at 850oF.

The recovery of that heat will greatly increase boiler efficiency and reduce

greenhouse gases.

This very large GDPS route includes detailed travel in specific decision trees.

In the case of hot gas filtration, this involves a wide choice of media.

John McKenna is a world expert on media selection. He has been involved

in McIlvaine “Hot Topic Hour” discussions on the subject. Here is

his presentation of media options as displayed on the site.

The decision maker has to weigh cost vs. the various properties. Some fabrics

have higher temperature resistance and others higher acid resistance. A

new technology pioneered by URS and others involves injection of sorbent ahead

of the air heater. This allows greater heat recovery without fear of acid

condensation. A collateral benefit is the ability to use lower temperature media

with less acid resistance. Does this open the door for acrylics?

John and other experts such as Clint Scoble of Testori will be available

during the session to address such questions.

The devil is in the details. Each aspect of filtration design needs be

evaluated. One topic introduced by McIlvaine is the bleed through of activated

carbon and other particulate along the seams of the bags. The new

regulations require very low emissions of particulate. The dust which can

escape through holes made by sewing the bags is sufficient to cause exceedances.

Sewing holes enlarge as a bag is continually pulsed (as many as 50,000 times

during its life). A utility participating in McIlvaine webinars explained that

activated carbon was observed on the clean side of the bags. This carbon

along with abrasive ash wedged between the bag surface and the cage and was

reducing bag life as well as causing emission problems.

McIlvaine made some disturbing calculations. The amount of mercury in the

escaping carbon could be enough to cause a mercury exceedance. Since the

mercury limit is 1,000 times lower than the discrete particulate limit and since

the carbon captures the mercury, the escaping carbon could be a very severe

problem.

W.L. Gore has addressed this problem by tapes which cover the sewing holes in

the bags that it provides. McIlvaine has yet to hear from the other bag

suppliers but expects them to speak up at the AFS conference and for useful

discussion and debate to occur. The fact that this GDPS initiative will

plough new ground is illustrated by the fact that EPA is still a step behind on

this subject. The EPA mercury measurement requirement is based only on the

measurement of the gaseous form. Uncontrolled plants only emit mercury gases so

the EPA decision was superficially logical. EPA failed to take into

account that the process for capturing the mercury converts it from a gas to a

particulate. McIlvaine webinars are establishing that particulate mercury

emissions at a number of controlled plants are the main mercury source.

This could be the ultimate demonstration of the horse shoe failure which caused

the battle to be lost. EPA requires limits of mercury equivalent to 0.005

milligrams/Nm3. Discrete particulate limits are 5 mg/Nm3. When EPA and the

environmentalists discover the fact that particulate mercury emissions can be

significant, we may face a situation where media suppliers have to provide media

with orders of magnitude lower emissions.

System suppliers are already complaining that leaks around the tube sheet

holding the bags can be enough to make the 5 mg/Nm3 difficult to achieve.

What is a problem for one is an opportunity for another. Suppliers of

adhesives, seals and even more rugged bags which resist pin holes can likely

develop a big new market. The direct applicability is the coal-fired power

industry in North America. The larger opportunity is hot gas applications

in many industries and many countries.

China is likely to gut the housings of its coal-fired precipitators and insert

bags. The driver is tough new regulations. The limited space dictates pleated

rather than tubular bags. Pleated

bags are more expensive, but with more effort, maybe the industry can make these

bags more competitive. So here is another opportunity which may involve

many different filter components and even coatings to provide rigidity.

There are other large hot gas applications which need to be addressed.

China is planning to obtain much of its gasoline, chemicals and pipeline gas

from conversion of coal. The process requires gasification of the coal and then

filtration. Porvair has been

successful in obtaining orders for its metal filters for this application in

India, South Korea and China.

Clarcor Purolator through its acquisition of Bekaert technology has experience

on a wide range of applications for metal filter media. Some studies show the

ability to obtain higher flows at equivalent pressure drop than with the ceramic

elements. Pavlos PAPADOPOULOS of Clarcor will be in the AFS discussion and will

be available during the conference to discuss these applications. Future

articles in Filtration News will

cover the applications in coal gasification, solid waste combustion, glass

furnaces, mining, etc.

One of the largest potential media developments is the catalytic filter.

The website has performance data on Clear Edge catalytic ceramic media filters

in conjunction with sodium sorbents on many hot gas applications. The ability to

filter and remove acid gases and NOx all in the same device is very

important. Haldor Topsoe and FLS

think this type of device is important enough to set up an entire joint venture

around it.

Another novel device is the Gore mercury module. The sorbent polymer composite

resides in a series of modules. Six

modules can achieve up to 95 percent removal. It can be placed downstream of a

scrubber. The combined efficiency can easily be above 99 percent.

So this provides an alternative to the hot gas filter with carbon

injection but also a way to change the whole industry.

Mercury regulations are continually moving to lower limits based on

maximum achievable control technology. A combination which can achieve 99

percent removal at reasonable cost will drive a new round of international

regulations.

Attendees at the AFS meeting will be advised to view the

Hot Gas

Filters - Continuous Analyses .in advance. This should ensure a

high level discussion at the conference. The June article will benefit

from continuing additions to the site and the intelligence gained at the

conference. The combined efforts will provide the most relevant decision options

and GDPS routes.

AIR FILTRATION MARKET UPDATE

FEBRUARY 2015

INDUSTRY

Filtration Society to Unearth Unmet Needs in Power Generation Conference

New Class of Adsorbents in Air Filters to Help Warfighters Breathe Easier

CONSTRUCTION

U.S. Housing Starts Up in December

COMPANY NEWS

SWM Acquires Air Filtration Assets from Pronamic Industries

Lydall Sells Charter Medical with Focus on Core Businesses

Fresh-Aire UV Expands Florida HQ

Sandler Focusing on Synthetic Air Filter Media for IAQ at FILTECH 2015

FINANCIALS

Clarcor Acquisitions Increase in Net Sales 39 percent for Q4 2014

Celanese Corporation Reports Record Fourth Quarter and Full Year 2014 Results

Ahlstrom Operative Result More Than Doubled in 2014

NEW PRODUCTS

Camfil's New CamExtend Offers Better Air Filtration that Pays for Itself

3M Introduces Versatile Air Purifying Respirator

Johns Manville to Unveil New Products at Filtech

HealthWay’s New Laminar Flow Filtration System Exceeds HEPA Standard

Many projects, mergers and acquisitions are detailed in monthly updates in the

Market Report’s Chapters under Industry Analysis.

|

AEROSPACE

FOOD

FLAT PANEL

METALWORKING

OTHER ELECTRONICS |

PHARMACEUTICAL

POWER

PULP MILLS

SEMICONDUCTOR

TRANSPORTATION |

GDP FORECAST

UPDATE

UNITED STATES

Estimates of US GDP growth for 2014's fourth quarter have been rising in recent

months, but the current outlook still anticipates a substantial slowdown from

Q3's strong advance. The economy is projected to increase 3.6% in Q4 (real

seasonally adjusted rate), based on The Capital Spectator's new median point

forecast for several econometric estimates. That's a solid rate of growth, but

the latest outlook still represents a substantially lesser pace vs. the 5.0%

increase previously reported for Q3.(The remaining text is not included in

this sample.)

China's 2015 GDP growth forecast has been maintained at 6.8 percent, as further

policy support and export recovery is expected to help bolster the sluggish

economy, according to UBS.

"December and Q4's better than expected data will unlikely trigger any immediate

significant new easing measures for now, but the first rate cut may happen

(around) March or April, when even lower CPI (consumer price index) and PPI

(producer price index) are reported," said Wang Tao, chief China economist with

UBS, said in a research note.

Wang added that policy support will intensify in 2015 with accelerated

pro-growth measures in areas such as price, social safety net and hukou

(household registration) reform, and more infrastructure projects.

Further monetary easing via liquidity provisions, including required reserve

ratio cuts, is expected to offset slower foreign exchange reserve accumulation

and benchmark rate cuts of at least 50 basis points are also expected to prevent

real rates from rising, according to UBS…(The remaining text is not included

in this sample.)

EUROPE / AFRICA / MIDDLE EAST

GERMANY

Media reports have claimed the German government has revised its 2015 growth

outlook for the national economy in 2015. It said GDP would grow by 1.5 percent

this year, up from a previous and more cautious estimate.

According to reports by Reuters and AFP news agencies, the German government

sees GDP growth come in at 1.5% this year, up from an earlier estimate of just

1.3% for the whole of 2015.

The figures are part of the government's 2015 Economic Outlook to be presented

by Economy Minister Sigmar Gabriel during an official news conference in Berlin.

The draft document says the improved outlook is mainly down to continuously low

oil prices and the most recent labor market data.

The German economy is "in good shape," the report says, with more people than

ever having a job and the unemployment rate expected to drop further to 6.6% in

2015, down from 6.7% last year. This would leave 2.9 million people out of work

in the country in the course of the year…(The remaining text is not included

in this sample.)

A complete analysis of GDP and monthly updates for individual countries are

included as part of Air Filtration and

Purification World Markets.

For more information on: Air Filtration

and Purification World Markets, click

http://home.mcilvainecompany.com/index.php/markets/2-uncategorised/108-n022.

WORLD POWER GENERATION PROJECTS

HEADLINES

This includes only projects where there was an update during the month.

There are thousands of projects in the database.

New power generation projects are tracked in two publications. Fossil and

Nuclear Power Generation includes both market forecasts and project data.

World Power Generation Projects has just the project data.

FUEL: NUCLEAR

|

Startup Date |

Location |

Fuel Comment |

Project Title |

|

Unknown |

Argentina |

|

Atucha 3 power plant |

|

Unknown |

Armenia |

|

Metsamor-Armenia replacement

nuclear power plant |

|

Unknown |

Azerbaijan |

|

Azerbaijan nuclear power plant |

|

Unknown |

Bahrain |

|

Bahrain nuclear power plant |

|

Unknown |

Bolivia |

|

Bolivia nuclear power plant |

|

Unknown |

Canada |

|

Point Lepreau 2-NB Power |

|

Unknown |

China |

|

Lianyungang 1,2-GCNPC |

|

Unknown |

China |

|

Taohuajiang 1-4 nuclear power

plant-CNNC |

|

Unknown |

China |

|

Shidaowan-China Huaneng Group |

|

Unknown |

China |

|

Shaoguan 1-4 nuclear power

plant-China Guangdong Nuclear

Power Holding |

|

Unknown |

China |

|

Shandong Shidaowan-Huaneng |

|

Unknown |

China |

|

Sanmen 3-6 expansion-CNNC |

|

Unknown |

China |

|

Sanba nuclear power plant-China

Guangdong Nuclear Power Group |

|

Unknown |

China |

|

Rongcheng, Shiaowan-CGNPC and

Huaneng NPDC |

|

Unknown |

China |

|

Taohuajiang-CNNC |

|

Unknown |

China |

|

Ningde 5,6-CGNPC |

|

Unknown |

China |

|

Jinzhouwan |

|

Unknown |

China |

|

Jingyu 1-4-CPI and Guodian |

|

Unknown |

China |

|

Hui'an/Fuqing 2 Units 3-6-CNNC |

|

Unknown |

China |

|

Pengze 3,4-CPI |

|

Unknown |

China |

|

Tianwan 3,4 Phase II nuclear

power plant-Jiangsu Nuclear

power Corp. |

|

Unknown |

China |

|

Heyuan (Jieyang) power plant

|

|

Unknown |

China |

|

Tianwan 7,8-CNNC |

|

Unknown |

China |

|

Shidaowan nuclear power

plant-Huaneng |

|

Unknown |

China |

|

Tianwei 1,2, Lufeng-CGNPC |

|

Unknown |

China |

|

Xiangtan 1-4-Huadian |

|

Unknown |

China |

|

Xianning (Dafan) 4-CGNPC |

|

Unknown |

China |

|

Xiaomoshan 1-6-CPI |

|

Unknown |

China |

|

Xinyang 1-4-CGNPC? |

|

Unknown |

China |

|

Xudabao 1,2 nuclear power plant |

|

Unknown |

China |

|

Yangjiang 5,6-CGNPC |

|

Unknown |

China |

|

Zhangzhou 1,2 nuclear power

plant-China Guodian Corp. |

|

Unknown |

China |

|

Zhexi 1-2nuclear power

plant-CNNC |

|

Unknown |

China |

|

Zhexi/Longyou 3,4-CNNC |

|

Unknown |

China |

|

Tianwan 5,6-CNNC |

|

unknown |

China |

|

Guidong-CPI |

|

Unknown |

China |

|

Changjiang 3,4-CNNC and Huaneng |

|

Unknown |

China |

|

Dafan/Gaokeng-CGNPC |

|

Unknown |

China |

|

Cangnan-CGNPC/Huaneng |

|

Unknown |

China |

|

Bailong/Fangchengang 2 Units

3-6-CGNPC |

|

Unknown |

China |

|

Bamaoshan, Wuhu 3,4-CGNPC |

|

Unknown |

China |

|

Changde nuclear power plant

(Hengyang)-CNNC |

|

Unknown |

China |

|

Baisha Pingman 1-4-CPI |

|

Unknown |

China |

|

Fuling 1-4-CPI |

|

Unknown |

China |

|

Haijia Haifeng 1,2-CGNPC |

|

Unknown |

China |

|

Haiyang 3,4-CPI |

|

Unknown |

China |

|

Haiyang 5,6-CPI |

|

Unknown |

China |

|

Haiyang 7,8-CPI |

|

Unknown |

China |

|

Hengren 1-4-CPI |

|

Unknown |

CO |

|

Colorado Energy Park nuclear

power plant |

For more information on World Power Generation Projects, click on:

http://home.mcilvainecompany.com/index.php/databases/28-energy/486-40ai

-------

You can register for our free McIlvaine Newsletters at:

http://www.mcilvainecompany.com/brochures/Free_Newsletter_Registration_Form.htm.

Bob McIlvaine

President

847-784-0012 ext 112

rmcilvaine@mcilvainecompany.com

www.mcilvainecompany.com