Robert

McIlvaine,

Robert

McIlvaine,CEO, McIlvaine Company

Hot Gas Filter Discussion Will Be Continued On July 2

Twelve experts weighed in on hot gas filtration options at the Power Conference

held by AFS in Charlotte eight weeks ago. This discussion will be

continued on July 2 at 10:00 a.m. The purpose will be to help decision makers

determine the options which are available and guide them to select the option

which best fits their unique needs.

The discussion will be a constructive review and new additions for the following

decision guide route map and summary

http://home.mcilvainecompany.com/images/Hot_Gas_Filter_Decision_Guide_April_30_2015.pdf

The decision guide starts with a clean slate. Why place the SCR ahead of

the particulate collector? Why use a rotary air heater with 10 percent leakage

and a discharge temperature of 320oF? Why use multiple devices

for particulate filtration, NOx reduction, and acid gas absorption?

Why not combine all the technologies in one device?

There are two options which are fully explored. One is the conventional

option which results in particulate filtration at 320oF. The

other is the catalytic filter with filtration at 850oF.

The 320oF option has two routes. One is to use a dry scrubber

and fabric filter. The other is to use an electrostatic precipitator.

This decision is dependent on the dust limit and the ability of the precipitator

to meet it. It is dependent on decisions about by-products. In fact there

are many factors which need to be considered. How will each option deal

with mercury? Are there water use and pollution concerns? What space is

available? What is the age and

condition of the existing air pollution control system?

As you can see, all these are addressed in the guide. However,

there was a difference of opinion on:

·

Achieving 5 mg/Nm3 particulate continuously with a dry precipitator

·

Bag designs for the filter alternative

·

Media designs

·

Fiber selection

·

Method of cleaning

The greatest differences of opinion related to the 850oF option,

should metallic elements be used and followed by an SCR? Two variations

are available: sintered metal fibers and sintered powdered metal.

Alternatively, why not use a ceramic catalytic filter element? Both

choices can be accompanied with DSI. If the catalytic filter is the

choice, then there are a number of related questions:

·

Will the catalytic filter element prove as good in large coal-fired boiler

applications as it has in industrial boilers, glass plants, mining operations,

etc?

·

Who will supply and guarantee the systems using catalytic filter elements?

·

Who will supply the elements?

·

Who will supply the catalysts and ceramic bundles?

One of the potential benefits of these expert discussions is the holistic

analysis. The question of pleated bags vs. tubular bags needs to take into

account the potential to vary the cleaning design. A more robust

pulse cleaning system and the pleated design may have to be matched against a

less robust cleaning design and the tubular bag.

There are billions of dollars being spent to improve the particulate removal

performance at coal-fired power plants in China, the U.S., South Africa, Europe,

Chile and even Russia. Cement plants and operators of industrial boilers

are also facing upgrades of their particulate removal systems at the same time

they are required to capture acid gases and reduce NOx. So this

discussion is an important one for combustor operators around the world.

Participants for Discussion on Hot Gas Filtration on July 2, 2015

Reid E. Thomas,

Technical Director, Menardi-Filtex

Dr. John McKenna,

Principal, ETS International, Inc.

Charles (Chuck) Capps,

VP Sales & Marketing, FL Smidth Airtech, Advanced Filtration Technologies

George Moeke,

Regional Manager, North Mid-west, Clean Air Systems, Pentair, Goyen Valves LLC

Rod

Gravley, Technology Director, Tri-Mer Corporation and

Kevin D. Moss, Business

Development Director, Advanced Technologies

Clint B.Scoble, Jr.,

President, Testori USA, Inc.

Manfred Salinger,

Rath Group

Details on the webinar are found at:

Click here to view schedule and register

Providing the Interface between End Users and Suppliers

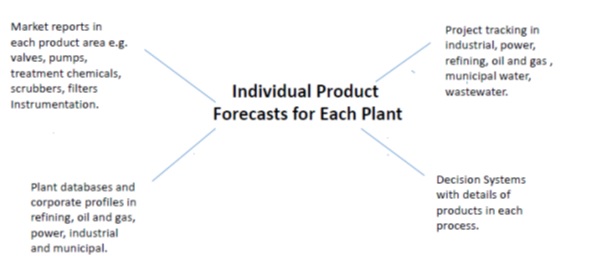

The McIlvaine Company has a number of initiatives to create high level

discussions among end users and suppliers. The purpose is to enhance the

decision making process. McIlvaine participated in a global sourcing panel

discussion at the Industrial Valve Summit in Italy last month. The major

oil companies and consultants all referenced the loss of experienced personnel

and the need to rectify this continuing loss of knowledge.

The panelists included some of the most knowledgeable valve experts who make or

influence decisions on many projects around the globe.

0.00 Round Table: Global sourcing in the changing energy industry

Room: Caravaggio

Keynote:

Robert

McIlvaine,

Robert

McIlvaine,

CEO, McIlvaine Company

Panelist

Bader

M. Al-Jarallah,

Bader

M. Al-Jarallah,

Valve Engineering Specialist, Saudi Aramco

Ray

Bojarczuk,

Ray

Bojarczuk,

Senior Engineering Advisor, Exxon Mobil Corporation

Are

Halvorsen,

Are

Halvorsen,

Managing Director, Nordic Valve Services AS

Ron

Merrick,

Ron

Merrick,

Director of Piping Material Engineering, Fluor Enterprises

Jean-Michel

Rivereau,

Jean-Michel

Rivereau,

Head of the Piping, Valves and Vessels Department, Technology Division, Total

E&P

Yusuke

Sakurai,

Yusuke

Sakurai,

Managing Director, Jgc Italy

Chaired by

Maurizio

Brancaleoni,

Maurizio

Brancaleoni,

Valve Campus

This live discussion in Italy was followed two weeks later by a recorded webinar

on power plant valves with various problems resulting from fast cycling of gas

turbine HRSGS and the next week with a discussion of the whole wet limestone FGD

system options. Three valve suppliers debated butterfly vs. knife gate

valves for slurry control.

McIlvaine webinars in the past have been two thirds presentations and one third

discussions. However beginning two months ago the webinars are 80%

discussion and only 20% presentations. The visual background each discussion is

a decision guide with as many as 90 power point displays. As the discussion

progresses the relevant information is displayed. The schedule of upcoming hot

topic is available at:

Click here to view schedule and register

FABRIC FILTER NEWSLETTER HEADLINES

June 2015

GAS TURBINE INTAKE FILTERS

MARKETS

PRECIOUS METALS

CEMENT

ASPHALT

COMPANY NEWS

For more information on World Fabric Filter and Element Market click on:

http://home.mcilvainecompany.com/index.php/markets/2-uncategorised/110-n021

GDP UPDATE

June 2015

TABLE OF CONTENTS

AMERICAS

o

Second Estimate of GDP for the First Quarter of 2015: FIVE KEY POINTS IN TODAY’S

REPORT FROM THE BUREAU OF ECONOMIC ANALYSIS

ASIA

EUROPE / AFRICA / MIDDLE EAST

AMERICAS

United States

Second Estimate of GDP for the First Quarter of 2015: FIVE KEY POINTS IN TODAY’S

REPORT FROM THE BUREAU OF ECONOMIC ANALYSIS

1. Real gross domestic product (GDP) fell 0.7% at an annual rate in the first

quarter of 2015, according to the second estimate from the Bureau of Economic

Analysis. The decline follows an increase of 3.6% at an annual rate during the

second half of 2014. First-quarter growth was likely affected by a number of

factors including especially harsh winter weather in the first quarter (see

point 3) and a spike in personal saving (see point 4). A decline in the trade

balance was another major contributor, partially reflecting the continued drag

on U.S. exports from the slowdown in foreign growth. Indeed, net exports

subtracted nearly 2 full percentage points from quarterly GDP growth. Structures

investment subtracted about 0.7 percentage point from GDP, likely reflecting

reduced oil mining in the wake of last year’s decline in oil prices.

Real private domestic final purchases (PDFP) — the sum of consumption and fixed

investment — rose 1.2% at an annual rate in the first quarter, a faster pace

than overall GDP. Real PDFP growth is generally a more stable and

forward-looking indicator than real GDP, as it excludes volatile components like

inventories, net exports, and government spending. PDFP is a better predictor of

next-quarter GDP than GDP itself. The year-over-year growth rate of PDFP rose

this quarter to 3.4%.

2. The entire downward revision to first-quarter GDP can be accounted for by

downward revisions to two especially volatile components of economic output:

inventory investment and net exports. Inventories and net exports subtracted a

combined 1.1 percentage points from annualized GDP growth relative to the Bureau

of Economic Analysis’ first estimate. At the same time, business investment

added 0.2 percentage point more than originally estimated. Other small revisions

to the contributions of personal consumption expenditures and residential

investment offset one another.

3. Over the past decade, first-quarter GDP growth has averaged a considerably

slower pace than the other three quarters. Economists have debated whether this

gap reflects a problem with the algorithms used to seasonally adjust GDP data

(“residual seasonality”), especially harsh winter weather in recent years, or

noise. The seasonal adjustment process should remove the growth effects of

“normal” winter weather, but particularly harsh winters will still reduce

seasonally adjusted output. And weather in the first quarter was especially

harsh: Q1 was only the fourth quarter in 60 years on record with three or more

snowstorms sufficiently severe to be rated by the National Climatic Data

Center’s Northeast Snowfall Impact Scale (NESIS). The historical relationship

between weather and first-quarter growth suggests that weather may have reduced

annualized growth by about a full percentage point this quarter, and by about

0.6 percentage point on average over the past decade. That effect accounts for

much, but not all, of first-quarter underperformance since 2005.

(The remaining text is not included in

this sample.)

ASIA

India

India, with an expected growth rate of 7.5% this year, is set to surpass China

and for the first time is leading the World Bank's growth chart of major

economies.

China is projected to grow at 7.1% this year.

Developing countries are now projected to grow by 4.4% this year, with a likely

rise to 5.2% in 2016, and 5.4% in 2017, the report said.

In China, the carefully managed slowdown continues, with growth likely to

moderate to a still robust 7.1% this year.

(The remaining text is not included in

this sample.)

EUROPE / AFRICA / MIDDLE EAST

Kyrgyzstan

Kyrgyzstan's economy has demonstrated steady growth in January to May, 2015.

The GDP amounted to 140 billion soms (approximately $2.36 billion) in the first

five months of this year, which is up by 6.9% compared to last year.

Inflation ratio rose by 1.2% in the country, according to the head of the

statistical information in National Statistical Committee, Chinar Turdubaeva.

The increase in GDP was ensured through the development of service, industry and

agriculture sectors.

The service sector had the largest contribution to the GDP, holding over 51% of

overall figure. The industry and agriculture sectors held 20 and 9%

respectively, while the building sector amounted to 6 percent.

Turdubaeva noted that the industrial production increased by 21.5% to 76 billion

soms ($1.29 billion) in this period. (The

remaining text is not included in this sample.)

A complete analysis of GDP and monthly updates for individual countries are

included as part of Electrostatic Precipitators: World Market or World

Fabric Filter and Element Market.

For more information on World Fabric Filter and Element Market click on:

http://home.mcilvainecompany.com/index.php/markets/2-uncategorised/110-n021

For more information on Electrostatic Precipitators: World Market click

on:

http://home.mcilvainecompany.com/index.php/markets/2-uncategorised/111-n018

OIL & GAS SALES LEADS HEADLINES

Oil and Gas Project Tracking is available at a discount to Electrostatic

Precipitators: World Market

or World Fabric Filter and Element Market subscribers.

Treatment chemicals are an important addition to most oil and gas processes.

Access to details on worldwide oil and gas projects is provided at a substantial

discount to Electrostatic Precipitators: World Market or World Fabric

Filter and Element Market subscribers.

(Listed by most current date)

Borealis and Agrifos Announce Major Milestone for U.S. Ammonia Production

Project

Revision Date:

6/18/2015

Mexichem Plans $800 Mln Investments in 2015, New Factories

Revision Date:

6/18/2015

Constructing a Facility Siting Plan and the Critical Safety Components

Revision Date:

6/18/2015

Shell Acquires Land for Proposed Appalachia Ethane Cracker

Revision Date:

6/18/2015

Staffing the 'Plastics Manufacturing Renaissance'

Revision Date:

6/18/2015

Egypt Signs $300 Mln Deal with UOP to Produce High-Octane Benzene

Revision Date:

6/18/2015

Chevron Phillips Chemical Considers New Mega-project in U.S. Petrochemicals

Revision Date:

6/17/2015

Asahi Kasei Opens New Production Lines for Duranol and Duranate at Chinese Plant

Revision Date:

6/17/2015

Manali Petrochemicals to Invest in Three Fold Expansion of Polyols Capacity

Revision Date:

6/17/2015

Tags:

325110 - Petrochemical Manufacturing

石化产品生产,

Manali PetroChemicals, Approval, Expansion, Manufacture, Investment, India

BASF Petronas Chemicals Breaks Ground on 2-EHAcid Plant in Malaysia

Revision Date:

6/17/2015

UOP's Tatoray™ Process Technology Producing Petrochemicals

Revision Date:

6/17/2015

Ineos Plans Ethylene Oxide Units Turnarounds in Belgium and Germany

Revision Date:

6/17/2015

Saudi Aramco-Dow JV Sadara Awards Jacobs EPCM Contract

Revision Date:

6/16/2015

Total Petrochemicals Chooses Port Arthur as Site for New Ethane Cracker

Revision Date:

6/16/2015

Pemex, Blackstone to Develop Water and Wastewater Infrastructure

Revision Date:

6/16/2015

Celanese Selects Jacobs for Singapore VAE Plant Contract

Revision Date:

6/15/2015

Azerbaijan Seeks Investors for Petrochemical Plant

Revision Date:

6/15/2015

Shell Moves towards Final Beaver County, PA Cracker Decision

Revision Date:

6/15/2015

Malaysia's Petronas Chemicals Says Sabah Urea Plant to Start up Early 2016

Revision Date:

6/15/2015

KBR Awarded Licensing & Design Services Contract for Ammonia Plants

Revision Date:

6/15/2015

Mideast, U.S. Hold Competitive Positions for Ethane Cracking

Revision Date:

6/12/2015

UAE's Borouge Says Third Phase Expansion to Reach Full Capacity by 2016

Revision Date:

6/12/2015

China Sets Higher Standards for New Petrochemical Projects

Revision Date:

6/11/2015

Mitsubishi and Subsidiaries to Construct Methanol & Dimethyl Ether Plant in

Trinidad & Tobago

Revision Date:

6/11/2015

Honeywell Opens New China Manufacturing Site for State-of-the-art Catalysts

Revision Date:

6/11/2015

Lamprell Awarded New Jackup Contract from NDC

Revision Date:

6/11/2015

CB&I Awarded Contracts for Shintech Ethane Cracker Project

Revision Date:

6/11/2015

Fluor Execs, Dignitaries Mark France Carbon Fiber Plant Project

Revision Date:

6/11/2015

Egypt's Carbon Holding Considers $4 Bln Loan for Petchem Project

Revision Date:

6/11/2015

China to Grant License for Imported Oil to Non-major Refinery

Revision Date:

6/11/2015

SOCAR & Maire Tecnimont Sign EUR 350 Mln EPC Contract

Revision Date:

6/10/2015

Thai PTT Global Shuts Olefins Plant for Maintenance

Revision Date:

6/10/2015

Developer Says Ohio Ethane Cracker Still Economically Viable

Revision Date:

6/10/2015

Saudi's Yansab to Shut Petchem Plants for Maintenance

Revision Date:

6/10/2015

Alibaba Group Helps Sinopec with Cloud Computing, Big Data

Revision Date:

6/10/2015

Saudi's SABIC Signs Deal to Use U.S. Shale Gas at British Plant

Revision Date:

6/10/2015

Japan's Maruzen Runs Naphtha Crackers at Full Capacity

Revision Date:

6/9/2015

PTT, Marubeni Select SE Ohio Site for Possible Ethane Cracker

Revision Date:

6/9/2015

Odebrecht and Braskem to Re-evaluate Proposed Cracker Plant in West Virginia

Brazilian petrochemical company Odebrecht and plastics maker Braskem say they

will re-evaluate an ethane cracker they proposed to build in West Virginia.

Revision Date:

6/9/2015

Saudi's Sipchem Has Finished Testing New Plastics Plant

Revision Date:

6/9/2015

Celanese, Mitsui May Build Methanol Plant at South Texas Facility

Revision Date:

6/9/2015

Adidas to Use Marine Plastic Waste in Products from 2016

Revision Date:

6/9/2015

Saudi Sipchem Says Plant Shutdown Cost $4.8 Mln

Revision Date:

6/9/2015

US Petrochemical Construction Boom and Refining Margins Cushion Profits

Revision Date:

6/8/2015

Bolivia Expands Petrochemical Capability with Bulo Bulo Ammonia Complex

Revision Date:

6/8/2015

Market Sources Say European Benzene Market Divided Amid Cracker Outages

Revision Date:

6/5/2015

YASREF Chooses Intergraph® Solutions for Refinery Project in Saudi Arabia

Revision Date:

6/4/2015

KBR Wins Project Management Consultancy Contract for Participation in Russian

Refinery Revamp Program

Revision Date:

6/4/2015

YASREF Chooses Intergraph® Solutions for Refinery Project in Saudi Arabia

Revision Date:

6/4/2015

Chevron Completes Flare System Revamp at Cape Town Refinery

Revision Date:

6/3/2015

Russia's Refinery Runs Down 1.2 Pct in April Month-to-month

Revision Date:

6/3/2015

Chevron Seeks to Share $1 Bln South Africa Refinery Cost

Revision Date:

6/3/2015

Jakarta Says Oman to Build Refinery, Petchem Plant in Indonesia

Revision Date:

6/3/2015

Brazil Auditor Blocks Tender for Petrobras-refinery Pipeline

Revision Date:

6/3/2015

PBF Energy Says Toledo FCC to Be Down 2-3 Weeks

Revision Date:

6/3/2015

Innovative Project Execution Solutions Improve Collaboration on Malaysian Mega

Project

Revision Date:

6/3/2015

NRL Secures $242 Mln Financing for Projects Upgrade

Revision Date:

6/3/2015

Pemex to Develop $950 Mln Refinery Power Plant with Enel, Abengoa

Revision Date:

6/2/2015

Air Products JV Gets $2 Bln Contract for World's Biggest Industrial Gas Plant

Revision Date:

6/2/2015

Galfar Engineering and Contracting Awarded Duqm Refinery Site Preparation Work

Revision Date:

6/2/2015

Technology from Honeywell's UOP to Run Largest Refinery in Africa

Revision Date:

6/2/2015

India's Numaligarh Refinery Extinguishes Fire in Hydrocracker Unit

Revision Date:

6/2/2015

Chevron Completes $83 Mln Maintenance at South African Oil Refinery

Revision Date:

6/2/2015

Dakota Prairie Refinery Commences Startup Operations

Revision Date:

6/2/2015

American Fuel & Petrochemical Manufacturers Analysis Highlights Refineries'

Reduced Emissions

Revision Date:

6/1/2015

EIA Chief Says No Hurry Needed for Lifting Crude Export Ban

Revision Date:

6/1/2015

GM of China's Largest Oil Refiner Sinopec under Investigation

Revision Date:

6/1/2015

For more information on Oil, Gas, Shale and Refining Markets and Projects

click on:

http://home.mcilvainecompany.com/index.php/markets/28-energy/471-n049

For more information on World Fabric Filter and Element Market click on:

http://home.mcilvainecompany.com/index.php/markets/2-uncategorised/110-n021

For more information on Electrostatic Precipitators: World Market click

on:

http://home.mcilvainecompany.com/index.php/markets/2-uncategorised/111-n018

INDUSTRIAL EMITTERS UPDATE HEADLINES

May, 2015 – No. 2

AMERICAS

Chemicals

·

Chevron Phillips Chemical Breaks Ground on Polyethlene Plant In Bartlesville, OK

·

Croda Breaks Ground On First Ever Facility to Produce Sustainable Non-Ionic

Surfactants

Food

·

Seaboard Foods, Triumph Foods to Jointly Build $264m Pork Processing Facility in

Iowa

·

Fitlife Foods to Open Food Production Center in Plant City, Florida

·

Wayne Farms to Create 500 Jobs in Alabama with Processing Plant Expansion

·

MG Foods' $2.55m Investment to Create 120 Jobs in Texas

·

Sopakco Expands Operations in South Carolina with New Fitment Pouch Line

·

Kelly Turkeys USA to Build New Poultry Production Facility in Virginia

·

Kellogg to Expand Cereal Production Plant in Canada

·

General Mills to Invest $253m to Expand Operations in Tennessee

·

Grupo LALA Inaugurates Phase I of $50m Dairy Plant in Nicaragua

Pulp and Paper

·

Cascades to Invest $26 million in Biorefinery Project at its Norampac Cabano, QC

Plant

·

Irving Pulp & Paper Invests over $640,000 in Saint John, NB Pulp Mill

Modernization

Biomass

·

Construction to Begin on Biomass-to-Fuels Facility in Oregon

Other Industries

·

ClearSign Field Test at Aera Validates Savings in Operating Costs for OTSG

·

Honeywell Helps Rock Island, IL Arsenal Boost Sustainability and Reduce

Emissions

·

Nonwovens Producer Avgol Expanding NC Facility

ASIA

Chemical

·

Evonik Opens Expanded Oil-Additives Plant in Singapore

·

Jacobs Awarded EPCM Contract by Huntsman for Singapore Polyetheramine Expansion

Food

·

Kinh Do, Saigon Ve Wong to Build $30m Instant Noodle Plant in Vietnam

·

Cargill to Commission Corn Milling Plant in India

·

ITC to Set Up Four Food Parks in Tamil Nadu, India

·

Fonterra Increases Mozzarella Production with New Clandeboye, New Zealand Plant

·

ADM to Set Up Feed Plants in China and Minnesota

·

Kawan Food to Commission New Factory in Malaysia

Other Industries

·

Asahi Kasei to build new spinning plant for Planova BioEX Filters

EMEA

Food

·

GrowUp Urban Farms gets nod to begin construction on aquaponic farm in UK

·

Mamee TGU to Build Instant Noodles and Snack Foods Factory in Saudi Arabia

·

Al Safi Danone Iraq to Receive Investment from IFC to Expand Dairy Operations

·

French Kiss Boosts Confectionery Production with New Moscow Facility

·

Vasari Global Opens Phase I of $150m Food Facility in Ethiopia

Pulp and Paper

·

BillerudKorsnäs Upgrades its 260,000-tonne/yr SC Fluting PM at Gruvön, Sweden

·

Mondi to Raise Pulp, Kraftliner Production at Swiecie mill in Poland

·

Russia’s Sveza Set to Start Construction of 1.2 Million-Tonne/Yr Kraft Pulp Mill

in 2017

Biomass

·

B&W Vølund Awarded Contracts for More than $220 Million to Design, Manufacture

and Operate UK Biomass Power Plant

Other Industries

·

Novo Nordisk Builds New Plant for Hemophilia Treatments

·

Nippon Shokubai Plans Belgium Investment for Superabsorbent Polymer

For more information on Industrial Emitters

http://home.mcilvainecompany.com/index.php?option=com_content&view=article&id=93extsup1.asp

WORLD POWER GENERATION PROJECTS

HEADLINES

This includes only projects where there was an update during the month. There

are thousands of projects in the database.

New power generation projects are tracked in two publications. Fossil and

Nuclear Power Generation includes both market forecasts and project data.

World Power Generation Projects has just the project data.

Fuel: Liquefied Natural Gas

|

Startup Date |

Location |

Fuel Comment |

Project Title |

|

2018 |

Japan |

|

Tohoku power plant |

|

2017 |

Taiwan |

|

Tunghsiao 1-5 CCGT Retrofit -

Taiwan Power Co |

|

2004 |

Japan |

|

Wakayama City Thermal Kansai

Electric Power Co. |

|

2001 |

Taiwan |

|

Hsinchu Science-based

Industrial Park power plant |

|

1994 |

Taiwan |

|

Talin 6-Taiwan Power |

|

1991 |

Japan |

|

Goi Thermal-Tokyo Electric

Power |

For more information on World Power Generation Projects, click on:

http://home.mcilvainecompany.com/index.php/databases/28-energy/486-40ai

----------

You can register for our free McIlvaine Newsletters at:

http://www.mcilvainecompany.com/brochures/Free_Newsletter_Registration_Form.htm.

Bob McIlvaine

President

847-784-0012 ext 112

rmcilvaine@mcilvainecompany.com

www.mcilvainecompany.com