How large is the Market for Gas Turbine CFT Products and Services?

Centrifugal, Reciprocating or Screw

Compressors for Fuel Gas Boosting

![]()

GAS TURBINE & RECIPROCATING ENGINE

DECISIONS UPDATE

August 2018

Table of Contents

How large is the Market for Gas Turbine CFT Products and Services?

Centrifugal, Reciprocating or Screw

Compressors for Fuel Gas Boosting

![]()

______________________________________________________________________________

Gas

Turbine Owners, Suppliers, Market Researchers and Publishing Companies Need to

Work Together to Provide Lowest Total Cost of Ownership Solutions

Gas turbine owners want to buy the equipment and consumables with the lowest

total cost of ownership (LTCO). Suppliers would like to validate that their

products are the LTCO choice. Publishers and conference organizers would like to

be facilitators to communicate the relevant information.

Market researchers need to understand the LTCO options in order to make

relevant forecasts and properly advise clients.

McIlvaine has two services relative to gas turbine combust, flow, and treat. One

tracks the projects and forecasts the markets.

The other provides insights for decision making and market forecasts.

This Update is part of that service.

The purpose of this service is to identify and classify the product and service

options which will impact the market. This can best be done with leveraging the

Industrial Internet of Wisdom. This in turn means interconnection between

knowledge resources and the personnel at supplier, operator, consulting, and

market research companies.

The traditional print magazines are now building blogs and on line access to

archives which provides valuable knowledge. The challenge is to make this

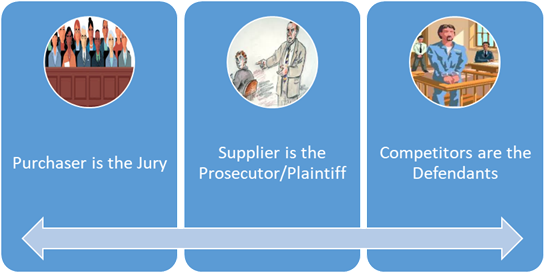

available as needed. A continuous trial by Jury could be used as an explanation

of how the IIoW can be leveraged.

The Jury is the purchaser. The prosecutor would be the supplier trying to

validate that his product has the lowest cost of ownership. The evidence to be

introduced would be papers and case histories. The defendants would be the

competitors. The counts would be the supplier claims as to why they have the

LTCO. Another analogy is the class

action vs individual law suit. The supplier will want to make a case for all

purchasers (class action) and then a case for each individual purchaser based on

site specific factors.

One difference to a trial is that the lowest total cost of ownership validation

(LTCOV) has to be continuous. New process or product developments have to be

continually addressed. Expert witnesses are needed.

Organized compilation of the evidence is needed.

The prosecutor (supplier) needs to assemble the facts and then display a

series of decisive classifications which lead to the conclusion desired.

There is a major role for market researchers in civil trials. The McIlvaine

Company has been an expert witness in cases involving theft of intellectual

property and disputes over monopolistic practices.

All these cases involved the decisive classification of options,

ramifications and forecasts for the revenue implications.

In some cases weeks or even months of review of the evidence and options

was necessary to prepare forecasts to be used relative to damages claimed.

Just as the plaintiff in a civil trial must spend the money to assemble the

evidence and present it, we believe that the suppliers are the ones to spend the

money to provide the interconnection between available knowledge and the people

who need to use it to make the LTCOs.

The immediate and convenient access to the relevant factors substantiated

by background data should be organized by the suppliers. Their websites should

provide the detailed links to the relevant blogs and papers appearing on

publisher sites.

Power Engineering

has now switched to an online format with extensive use of blogs with valuable

information. For example it has

published the first of a three part analysis by Brad Buecker now with Chemtreat

and formerly with consulting and operating companies.

https://www.power-eng.com/articles/2018/08/better-chemistry-at-combined-cycle-and-co-generation-plants-part-i.html

Brad has a wealth of experience in gas turbine power plant processes including

treatment chemical options. In this current blog he advises that the serious

potential for FAC needs to be addressed by continuous on-line sampling. This

includes critical parameters such as iron and copper. He asserts that

non-phosphorous cooling tower chemistry is evolving to mitigate discharge issues

and offer better corrosion and scale protection.

You can search under “chemicals” on the

Power Engineering Website and

find a number of articles including the following by Brad in February 2018.

https://www.power-eng.com/articles/print/volume-122/issue-2/features/maintaining-high-combined-cycle-hrsg-efficiency-and-reliability.html

Combined Cycle Journal has a very effective archives link to view articles such

as one written about amines based on a 2017 Users meeting. Amines—both

neutralizing and filming, as well as proprietary filming products—have the

potential to reduce corrosion in heat-recovery steam generators (HRSGs),

condensers steam and cycle chemistry.

The University of Illinois hosts an annual Electric Utility Chemistry Workshop.

Here is the program for 2018

Tuesday, June 5

|

Noon |

Registration |

|

1:30 PM |

Welcome |

|

|

|

|

1:45 PM |

Environmental Regulations Effecting the Electric Utility Update |

|

|

|

|

2:15 PM |

Flow Accelerated Corrosion |

|

|

|

|

2:45 PM |

Managing Boiler Chemical Cleaning Wastewater - Options Under NPDES and

RCRA - A Case Study |

|

|

|

|

|

|

|

3:15 PM |

Break |

|

3:30 PM |

Resin Fouling, Etc., or Trace Contaminants |

|

|

|

|

4:00 PM |

HP Turbine Foam Cleaning |

|

|

|

|

4:30 PM |

Microbiologically Influenced Corrosion: What It Is; What It Isn't; and

Associated Myths |

|

|

|

|

|

|

|

5:00 PM |

Reception and Vendor Display |

|

|

|

|

|

Wednesday, June 6

|

7:30 AM |

Registration |

|

8:00 AM |

Introduction and Announcements |

|

|

|

|

8:05 AM |

Closed Cooling Water Contamination and Online Remediation |

|

|

|

|

8:35 AM |

Interpretation of Plant Chemistry Data and Applying This for Solving

Problems |

|

|

|

|

9:05 AM |

CCRO: The New Standard for Boiler Makeup & Process Water |

|

|

|

|

9:35 AM |

Break |

|

10:15 AM |

Understanding and Effectively Managing Your Condensate Polishing System |

|

|

|

|

10:45 AM |

Corrosion Product Transport Monitoring with Nepholometry |

|

|

|

|

11:15 AM |

Gravity Chemical Feed Systems for Cooling Towers at NIPSCO's R. M.

Schahfer Station |

|

|

|

|

|

|

|

12:00 PM |

Lunch Break |

|

1:00 PM |

Factors Affecting Selection of Technology for Water Treatment |

|

|

|

|

1:30 PM |

Unit 3 Silica Contamination; A Perfect Storm |

|

|

|

|

2:30 PM |

Break |

|

3:15 PM |

Safety Considerations of Boiler Chemical Cleaning |

|

|

|

|

3:45 PM |

Intelligent Chemistry Alarms |

|

|

|

|

4:15 PM |

An Ounce of Prevention |

|

|

|

|

4:45 PM |

Trends in Biological Treatment for FGD Wastewater |

|

|

Thursday, June 7

|

7:30 AM |

Registration |

|

8:00 AM |

Introduction |

|

|

K. Anthony Selby, Water Technology Consultants, Inc., Workshop Chair |

|

8:05 AM |

Condenser and Heat Exchanger Cleaning |

|

|

|

|

8:35 AM |

Neutralizing Amines |

|

|

|

|

9:05 AM |

Evaluation of Long-Term Membrane Performance |

|

|

|

|

9:35 AM |

Break |

|

10:00 AM |

Utilizing Digital Tools to Optimize Mobile Water System Operations |

|

|

|

|

10:30 AM |

Effects of Film Forming Products on Iron Monitoring in the Steam Cycle |

|

|

|

|

11:00 AM |

Extending Tube Life |

|

|

|

|

11:30 AM |

Wastewater Chlorination Compliance |

|

|

|

|

12:00 PM |

Workshop Wrap Up |

These and past presentations provide valuable knowledge. It would be desirable

for these papers to be available for use in decision systems with proper

compensation for the organizers.

Associations such as EPRI are important information sources. DOE and EPA in the

U.S. and their counterparts in other countries are also information sources. Gas

turbine users’ groups and component user groups such as HRSG Users are also

information sources. They hold annual meetings. Last February there were a

number of good papers at the HRSG Users meeting, e.g.

Preliminary discussions with this group were positive relative to working with

the industry to interconnect the conference with a continuing IIoW program.

A company such as Chemtreat can set up a website and provide links to the blogs

and archives as well as conference papers. Since Chemtreat is part of Danaher

with Hach, Pall, and McCrometer the website can cover other CCJ postings such as

a number of articles under Hach and Pall including

http://www.ccj-online.com/archives/2q-2011/western-turbine-users/.

They include access to articles on varnish removal dating back to 2006

http://www.ccj-online.com/options-for-preventing-eliminating-varnish-in-hydraulic-lube-oil-systems/

The service that suppliers can

provide is make total cost of ownership analyses and then link to the various

publisher websites to validate the analysis with background data.

The McIlvaine role is to make Serviceable Obtainable Market (SOM)

forecasts based on the LTCOVs of the various suppliers for each product

How

large is the Market for Gas Turbine CFT Products and Services?

Sales of combust, flow, and treat products and services for gas turbine power

plants will exceed $80 billion this year. This is the latest forecast in

59EI Gas Turbine and Reciprocating Engine Supplier Program.

This forecast does not include the gas turbines, steam turbines or HRSGS but

does include all the valves, pumps, piping, filters, emission control and other

products. It includes the instrumentation and the process management software.

It includes the repair and replacement of all these components as well. It

includes consumables such as inlet air filters and water treatment chemicals.

GTCC plant owners will spend $1.4 billion this year just for corrosion and scale

inhibitors.

The details on this market are covered in a McIlvaine YouTube analysis

https://youtu.be/OBeeTfWgb9A

Third

Party Operators and LTCOV

Suppliers of systems and third party operators have an incentive to prepare LTCO

analyses for every product and service used in a gas turbine systems. Third

party operation is expanding and will accelerate the adoption of IIoT and Remote

O&M. Large plant suppliers such as MHPS and Doosan are moving into remote

monitoring and operational support. ITOCHU/NAES is now operating hundreds of

plants.

ITOCHU/NAES can play a pivotal role in creation of LTCOVs. They are an owner,

third party operator and supplier.

They are involved in power plants around the world. Their annual purchases are

over $1 billion.

ITOCHU

Annual CFT Purchases

|

Item |

$ millions |

|

Valves |

240 |

|

Pumps |

220 |

|

Guide |

200 |

|

Control |

280 |

|

Measure Solids |

24 |

|

Measure Liquids |

52 |

|

Measure Gas |

36 |

|

Cross Flow

Filtration |

92 |

|

Cartridges |

10.5 |

|

Sedimentation/

Centrifugation |

36 |

ITOCHU is one of the largest Japanese sogo shosha (general

trading company). Among Japanese trading companies, it is distinguished by not

being descended from an historical zaibatsu group, but by the strength of its

textiles business and its successful business operations in China. It has six

major operational divisions specializing in textiles, metals/minerals, food,

machinery, energy/chemicals and ICT/general products/real estate.

ITOCHU was ranked 215th on 2017's list of Fortune Global 500 companies with an

annual trading revenue of 44.65 billion USD.

ITOCHU is a member of the Mizuho keiretsu, which at one time was the largest

bank in the world and holds $1.8 trillion of U.S. debt.

Machinery Division

The company's Machinery Company segment consists of three divisions: The Plant

Project, Marine & Aerospace Division, the Automobile Division, and the

Construction Machinery & Industrial Machinery Division. It develops businesses

in a range of fields, including electric power generation, petrochemicals,

bridges, railways and other infrastructure related projects, aircraft, ships,

automobiles, construction machinery, industrial machinery and other businesses

related to machinery, and healthcare businesses.

It offers Engineering, Procurement and Construction (EPC) services, finance

structuring capacity, investment and coordinating functions among stakeholders

for projects in the field of oil, gas and petrochemicals; power generation and

transmission, and social and transportation infrastructure, such as railways,

bridges and ports. It focuses on the business field of water and environmental

related projects, which include seawater desalination facilities and power

generation from geothermal sources, wind, biomass or waste.

The company is engaged in various aspects of power generation projects, such as Independent Power Producer (IPP) businesses, developing and investing in power generation that utilizes renewable energies, such as geothermal, wind power, biomass and Energy from Waste.

The company focuses on pursuing projects relating to oil and gas development and

production, refineries, liquefied natural gas (LNG), the petrochemical industry

and energy infrastructure. It focuses on various functions, which range from

project identification/formation, EPC, financing structuring, coordination of

raw materials supply and off taking of final products, structuring international

consortia and project investment. It intends to focus on desalination, water

supply and sewage projects. It caters to railways, roads, bridges, ports,

airport facilities and other forms of social infrastructure.

NAES

In

2001 ITOCHU purchased NAES Corporation (headquartered in Issaquah,

Washington). NAES is the largest third party power plant O&M services

provider in the United States and worldwide. NAES currently provides O&M

services to over 120 power plants in the United States and has the track

record to provide O&M services totaling 254 power plants (approximately 72

gigawatts of power generating capacity) in 12 countries. In addition, NAES

provides engineering and consulting services to the power industry and

fabrication, maintenance and construction services to the power, oil & gas,

petro-chemical, and pulp & paper industries.

Recently, NAES acquired PurEnergy LLC (headquartered in New York), a

provider of power plant operations and maintenance services and asset

management services.

PurEnergy has deep expertise and track records, not only in power plant O&M

services, but also in asset management services, wherein the company manages

power plant operation, including contract management of power purchase, fuel

supplies and other financial agreements. PurEnergy currently provides power

plant O&M services to 14 plants in the United States and Canada, and asset

management services to 20 plants in the United States. Through this

acquisition, NAES will be able to cater to a wider variety of customer needs

by benefiting from PurEnergy's capabilities about asset management as a way

to optimize the reliability and efficiency of power plant assets, while

expanding customers in the power plant O&M services fields.

Through its diversified industry network, ITOCHU plans to further enhance

the business value of its portfolio companies in the power industry in the

United States where the demand for electricity is projected to increase

steadily.

NAES Corporation recently has assumed the care, custody and control of 830 MW

GTCC Hunterstown Generating Station near Gettysburg, PA. “NAES has consistently

delivered the kind of operational excellence that aligns with our vision of

modernizing America’s power generation by leveraging global technology and

strong partnerships,” said Mark McDaniels, Asset Manager at CPV who oversees O&M

at Hunterstown. “This agreement reflects our confidence in NAES’s ability to

optimize Hunterstown’s performance.”

In this case the owner is relying on NACE to leverage global technology. This

would imply that NAES is compiling the LTCO on each product and service.

It would seem logical for NAES to create its own decision system for LTCO

of plants and incorporate the LTCO data on products from the suppliers.

Doosan increasingly expanding O&M Role

As Doosan expands its O&M role there is the need to determine the LTCO of

various components. With remote monitoring this task is being made easier.

Doosan Heavy Industries & Construction has begun a drive to expand its power

plant service business by integrating power plant engineering, which has been

conventional manufacturing, with the latest information and communication

technology (ICT). The company announced the opening of the new Software Center

at its Seoul Office, following on from the launch of its Remote Monitoring

Service Center (RMSC).

The RMSC and the Software Center collect and analyze the streams of big data

generated by power plant operation, as part of a process that is expected to

enhance plant availability and optimize operational efficiency.

The RMSC, located at the company's Changwon Headquarters, is equipped with an

early warning system for abnormal operational conditions, and a real-time

monitoring system. Via an exclusive telecom network, the center receives data on

core facilities’ operations from the control center of a power plant in real

time, and instantly provides an optimized solution in the event of a problem.

By processing the massive amount of accumulated data received through the RMSC,

the software center provides information and solutions that can improve the

technical design of power plants, enhance operational efficiency, and provide an

advanced repair service.

Doosan Heavy Industries & Construction aims to win projects to provide a

long-term maintenance service for three to four power plants in Korea within the

year, and plans to make inroads into overseas markets, including Vietnam, Saudi

Arabia, and Indonesia.

Chairman & CEO Geewon Park of Doosan Heavy Industries & Construction stressed

that, "The integration of ICT and power plants is a new challenge for the

company which will expedite our future growth. Through the ICT-based RMSC and

the Software Center, we expect to not only increase our customer value but also

to expand our service markets."

Starting from RMS implementation for the Yeongwol Cogeneration Plant in 2012,

I&C has expanded RMS service to the Yangju Cogeneration Plant, Hanam

Cogeneration Plant and to the Dangjin Thermal power plant.

In 2017, operation data of gas turbines in the Dongtan 2 Cogeneration plant is

monitored in real-time in the DHI RMS center. I&C has implemented an early

warning system, Turbine rotor vibration analysis system, Turbine start-up

analysis system, etc. and also built big data analysis environment for DHI

products and continues to significantly contribute to DHI’s power generation

service expansion.

Centrifugal,

Reciprocating or Screw Compressors for Fuel Gas

Boosting

![]()

A fuel gas boosting compressor is important for gas turbine power plants because

if the fuel gas compressor fails, the gas turbine power plant stops entirely.

As a result, compressors are critically important for reliable gas

turbine power plant operation. At the same time, the demands on compressors have

been increasing because gas turbines require higher fuel gas pressures to

achieve increased performance efficiency and because pipeline pressures

fluctuate due to increased overall and peak demand requirements. Therefore,

selecting the correct type of fuel gas compressor is one of the most important

factors in achieving successful plant operation. These observations were made 10

years ago by Takao Koga of Kobelco.

However, as higher efficiency gas turbines were developed, the required gas

pressure kept increasing. The required gas pressure for conventional types of

industrial gas turbines is around 250 to 300 pounds per square inch gauge

(psig), or 17.5 to 21 barG on average. However, the latest generation of

industrial gas turbine requires relatively high pressure gas, such as 500 to 600

psig (35 to 42 barG). In addition, aeroderivative-type gas turbines now require

gas pressure as high as 700 to 1,000 psig (49 to 70 barG).

At the same time, natural gas demand has been increasing so that the new

development and supply of natural gas is not sufficient for the growth of demand

in many parts of the world. As a result, the gas pressure in the pipeline cannot

be maintained as high as before. This is particularly true during peak demand

such as summertime or daytime. It means that the gas pressure in the pipeline

would gradually decrease and even fluctuate.

A fuel gas compressor should properly handle such fluctuating gas pressure from

the pipeline while simultaneously meeting the gas turbine’s required gas flow

rate. Two changeable conditions are most relevant to fuel gas compressors:

suction gas pressure fluctuation and the turbine’s load changes.

In addition, reduced oil carryover and low pulsation/vibration are also

important, because they can lead to mechanical problems. Pulsation in particular

is a big concern to gas turbines with dry low NOX

combustors, since the combustor is more sensitive to pulsation. In addition,

natural gas can include impurities or dirt and its precise composition can even

be subject to change.

There are three basic gas compressor designs exist: centrifugal, reciprocating

and screw. Each design has mechanically different features. To date, centrifugal

and reciprocating types have been used mainly for fuel gas boosting services in

the United States and Europe. Screw-type fuel gas boosting compressors have been

used mainly in Japan and Asian market

In 2016 Sundyne, a leader in the design and manufacture of highly-engineered centrifugal pumps and integrally geared compressors for use in the global oil and gas production, refining, petrochemical, and chemical industries, announced a new series of fit-for-purpose centrifugal gas compressors, which are ideal for applications associated with the power generation market.

As ever-increasing demand for clean energy leads to widespread use of gas turbine power generation in industrial and commercial power plants, many such facilities now require reliable centrifugal compression to boost fuel gas from the low pressure delivered in the pipeline to the higher pressures used by the turbine. Sundyne integrally geared compressors in the 20 to 7,500 kW range offer the optimal solution for aero-derivative, industrial and frame type gas turbines rated from 20 MW to more than 500 MW output.

Based on 50 years of

compressor development experience, Sundyne fit-for-purpose skid-packaged fuel

gas boost compressors handle this service with efficiency and reliability,

ensuring a steady supply of fuel gas at the precise pressures needed for optimal

turbine operation. Additionally, Sundyne compressors offer a smaller footprint

than competing reciprocating and screw technologies, providing oil-free

operation and a smooth, centrifugal flow that eliminates pulsations, offering a

high-performance choice.

McIlvaine Company

Northfield, IL 60093-2743

Tel: 847-784-0012; Fax:

847-784-0061

E-mail:

editor@mcilvainecompany.com

Web site:

www.mcilvainecompany.com