August 2023 - Stainless Steel Engineer

Pursuing the Niche Markets

in Stainless Steel

In the Air, Water, Energy markets, and specifically in stainless

steel

there is a notable difference between sales and cost control, it

is the organized attention to detail.

The Stainless Steel Industry achieves EBITDA of 15-20% but should

be moving the numbers 10 points higher.

The way to do it is to devote the same attention to detail.

Every AWE company uses systematic cost analysis and should do

the same with sales.

Another salient fact is that there is no giant

stainless steel market. There are hundreds of thousands of niche

markets which can be aggregated to provide a total.

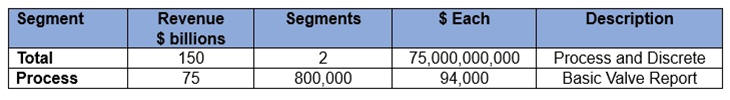

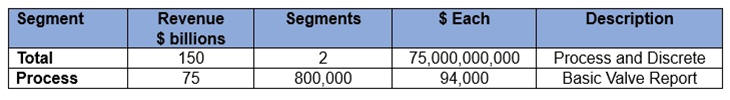

World Valve Market

Individual $94,000 niches can be combined like LEGO blocks into

various niche combinations.

Flowserve just purchased Velan to create the

world’s 2nd largest valve company

with revenues of close to $1 billion and EBITDA

of 15%. Revenues are only a little over 1% in a

market of mostly industrial process

applications.

When you add the small discrete valves

and commercial and other applications the market

is over $200 billion/yr.

It takes a minimum of at least 20% market

share before you can hope for EBITDA in the 25

to 30% range. Velan sells double offset

butterfly valves for hydrogen service and is

achieving more than 20% market share in this

niche. The goal is to achieve this capability

across all pursued niches.

IDEX sells pumps, valves, fittings and related products and is

achieving 30% EBITDA. The mission statement alludes to the niche

focus.

Companies should gather comprehensive information about each niche and then

pursue those which will result in high EBITDA and at least a 20% market share.

Millions of statistics need to be maintained. It starts with facts which then

are multiplied by factors.

The end result is a high EBITDA aggregation of niche markets (1).

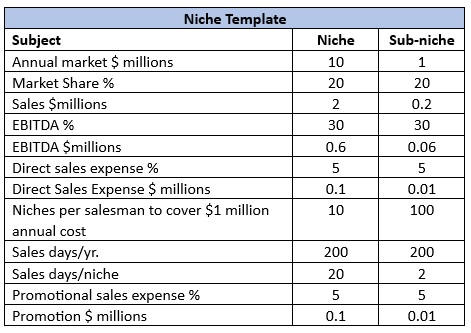

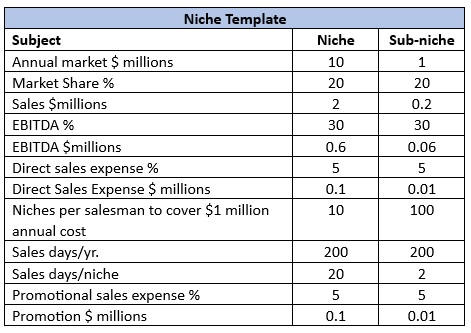

A market niche of $10 million with 10 sub niches fits all the criteria as shown

below.

A company with revenue of $100 million and 30% EBITDA would be targeting 50

niches and 500 sub niches. It would also need to track thousands of other sub

niches which it elects not to pursue.

It also needs to assess the competition and then create value

propositions in each niche. These need to be validated by company employees. A

Directory of Niche Value Propositions has been prepared as per the following

index excerpt.

Excerpts from the index to the AWE Value Proposition Directory

|

1086

|

KSB Sisto

|

hydrogen swing check valve

|

|

1087

|

ITT Habonim

|

Hydrogen cryogenic ball valves

|

|

1088

|

Bray

|

Hydrogen double offset butterfly

valve

|

|

1089

|

Swagelok

|

Hydrogen needle valve

|

|

1090

|

Velan

|

Hydrogen double offset Butterfly

valve

|

|

1091

|

Ampo

|

Hydrogen ball valve

|

|

1092

|

Marmon Ind,

|

Coal plant ww. treatment

|

|

1093

|

Camfil

|

GT air filter

|

|

1094

|

ITT

|

FGD knifegate valve

|

|

1095

|

MHI

|

CO2 absorber

|

|

1096

|

MHI

|

Hydrogen fired gas turbine

|

|

1097

|

MHI

|

FGD limestone scrubber

|

The Value Proposition summaries are included as per this example of the MHI CO2

absorber for bioenergy plants.

|

MHI CO2 ABSORBER VP:

# 1095

|

|

Company

|

Location

|

Industry

|

Process

|

Products

|

|

MHI

|

Europe, Americas, Asia

|

Bioenergy

|

CO2 capture

|

K21 absorber

|

|

Value Proposition: With aa new

absorbent MHI can capture more

than 99% of the CO2 with low

solvent losses

|

|

Contact:

xxxxxx, Product manager,

email xxxxxx phone xxxxxxxx

mobile xxxxxxxxxxxxxxx

|

|

Contact:

xxxxxx, Product manager,

email xxxxxx

phone xxxxxxxx

mobile xxxxxxxxxxxxxxx

|

|

Contact: xxxxxx, Product manager, email xxxxxx phone xxxxxxxx mobile xxxxxxxxxxxxxxx

|

|

|

|

Description: KS-21™ enable the compound to absorb CO2 more effectively than other solvents. It also degrades at a higher temperature than most solvents currently in use and it has a lower vapor pressure, resulting in reduced losses. This combination makes KS-21™ more efficient: Higher regeneration temperatures can be used to release the CO2, and since the solvent resists thermal and vaporization losses, it doesn’t need to be replenished as frequently.

|

|

The value propositions of OEMs shape the markets for the component suppliers.

The MHI breakthrough to reach 99% CO2 recovery promises to make small CO2

recovery systems attractive. Waste

to Energy and other smaller CO2 generators in the UK will have both a pipeline

to take the CO2 away as well as an efficient way to remove the CO2.

Relatively high investments are required in pumps, valves, compressors,

hose, fittings and stainless steel. Companies such as Ingersoll Rand and Atlas

Copco are creating niches by acquiring companies which make the pumps and

valves. They can be combined with the compressors into packages.

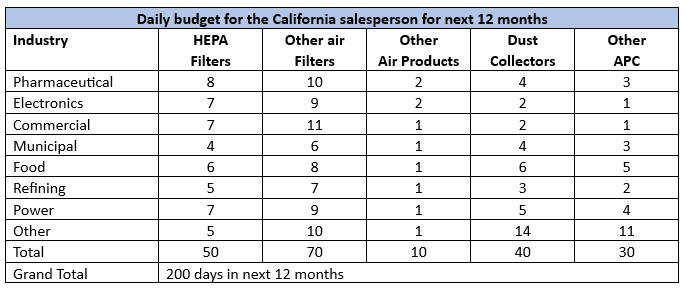

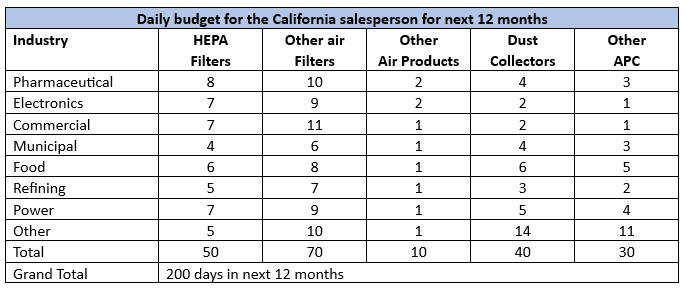

Following the lead of the finance department the statistics can be utilized to

create very specific guidance for salesmen. This salesman for a filter company

sells pulse jet valves along with the filters. Hose and couplings for dust

discharge are sold along with unit collectors. Pumps are sold as part of

scrubber systems. The number of days to spend each year in each application is

budgeted.

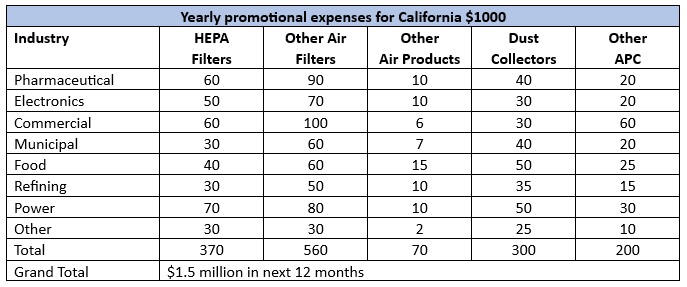

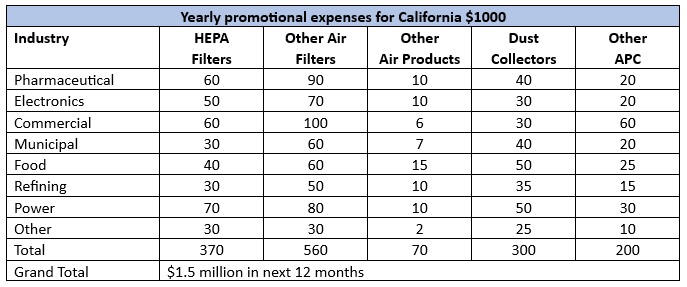

Promotional expenses can be determined the same way. The template allows

$100,000 of promotional expense per niche. California represents 3% of the

revenue or $30 million. So, the promotional budget would be $1.5 million.

The advertising and exhibition investment should ensure the validation of the

value propositions for the sub-niches. The California market will benefit from

some combination of local, national, and international promotion. It is likely

that $1 million would be allocated to national and international promotion and

only $500,000 to strictly local promotion.

Make the CFO happy and emulate finance in the sales program.

(1)

Most Profitable Market Program published by the Mcilvaine Company